Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Houlihan Lokey Inc (NYSE:HLI).

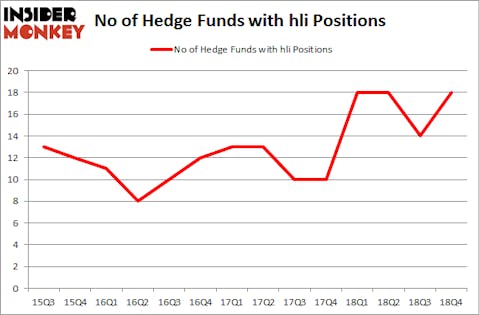

Houlihan Lokey Inc (NYSE:HLI) shareholders have witnessed an increase in support from the world’s most elite money managers lately. Our calculations also showed that hli isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to go over the key hedge fund action regarding Houlihan Lokey Inc (NYSE:HLI).

How have hedgies been trading Houlihan Lokey Inc (NYSE:HLI)?

At the end of the fourth quarter, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in HLI a year ago. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ariel Investments, managed by John W. Rogers, holds the biggest position in Houlihan Lokey Inc (NYSE:HLI). Ariel Investments has a $53.5 million position in the stock, comprising 0.7% of its 13F portfolio. On Ariel Investments’s heels is Royce & Associates, led by Chuck Royce, holding a $35.1 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish contain Jim Simons’s Renaissance Technologies, Israel Englander’s Millennium Management and Ken Griffin’s Citadel Investment Group.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. Buckingham Capital Management, managed by David Keidan, initiated the most valuable position in Houlihan Lokey Inc (NYSE:HLI). Buckingham Capital Management had $1.4 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $1.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management, Hoon Kim’s Quantinno Capital, and Mike Vranos’s Ellington.

Let’s also examine hedge fund activity in other stocks similar to Houlihan Lokey Inc (NYSE:HLI). These stocks are Nextera Energy Partners LP (NYSE:NEP), Rexnord Corp (NYSE:RXN), The Geo Group, Inc. (NYSE:GEO), and Pampa Energia S.A. (NYSE:PAM). All of these stocks’ market caps are closest to HLI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEP | 12 | 35346 | 0 |

| RXN | 19 | 133137 | 4 |

| GEO | 18 | 95266 | 1 |

| PAM | 15 | 295211 | 0 |

| Average | 16 | 139740 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $138 million in HLI’s case. Rexnord Corp (NYSE:RXN) is the most popular stock in this table. On the other hand Nextera Energy Partners LP (NYSE:NEP) is the least popular one with only 12 bullish hedge fund positions. Houlihan Lokey Inc (NYSE:HLI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on HLI as the stock returned 33.3% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.