The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Hologic, Inc. (NASDAQ:HOLX) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

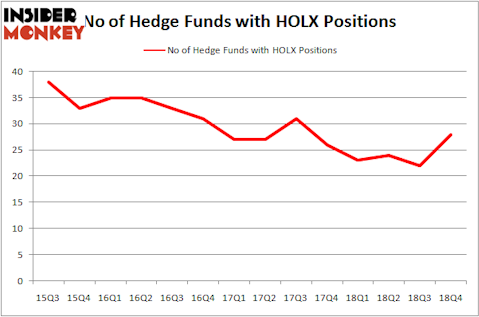

Hologic, Inc. (NASDAQ:HOLX) shareholders have witnessed an increase in enthusiasm from smart money of late. HOLX was in 28 hedge funds’ portfolios at the end of December. There were 22 hedge funds in our database with HOLX positions at the end of the previous quarter. Our calculations also showed that HOLX isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are tons of gauges investors have at their disposal to size up stocks. A pair of the less utilized gauges are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top money managers can outperform the market by a solid amount (see the details here).

We’re going to go over the recent hedge fund action surrounding Hologic, Inc. (NASDAQ:HOLX).

What does the smart money think about Hologic, Inc. (NASDAQ:HOLX)?

At Q4’s end, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HOLX over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Hologic, Inc. (NASDAQ:HOLX) was held by Glenview Capital, which reported holding $407.5 million worth of stock at the end of September. It was followed by D E Shaw with a $71.9 million position. Other investors bullish on the company included Millennium Management, Balyasny Asset Management, and Two Sigma Advisors.

Now, specific money managers were breaking ground themselves. Element Capital Management, managed by Jeffrey Talpins, initiated the largest position in Hologic, Inc. (NASDAQ:HOLX). Element Capital Management had $21.6 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $18.9 million investment in the stock during the quarter. The following funds were also among the new HOLX investors: Stanley Druckenmiller’s Duquesne Capital, Arthur B Cohen and Joseph Healey’s Healthcor Management LP, and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Hologic, Inc. (NASDAQ:HOLX). These stocks are Teleflex Incorporated (NYSE:TFX), Rollins, Inc. (NYSE:ROL), Altice USA, Inc. (NYSE:ATUS), and WellCare Health Plans, Inc. (NYSE:WCG). This group of stocks’ market values are similar to HOLX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TFX | 15 | 596575 | -2 |

| ROL | 22 | 269805 | 5 |

| ATUS | 51 | 1375717 | 4 |

| WCG | 39 | 955525 | 4 |

| Average | 31.75 | 799406 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $799 million. That figure was $803 million in HOLX’s case. Altice USA, Inc. (NYSE:ATUS) is the most popular stock in this table. On the other hand Teleflex Incorporated (NYSE:TFX) is the least popular one with only 15 bullish hedge fund positions. Hologic, Inc. (NASDAQ:HOLX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on HOLX, though not to the same extent, as the stock returned 15.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.