It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Hoegh LNG Partners LP (NYSE:HMLP).

Hoegh LNG Partners LP (NYSE:HMLP) investors should be aware of an increase in hedge fund sentiment lately. Our calculations also showed that hmlp isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are plenty of tools market participants employ to evaluate publicly traded companies. Some of the less utilized tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite money managers can beat the market by a healthy margin (see the details here).

Let’s review the new hedge fund action regarding Hoegh LNG Partners LP (NYSE:HMLP).

What does the smart money think about Hoegh LNG Partners LP (NYSE:HMLP)?

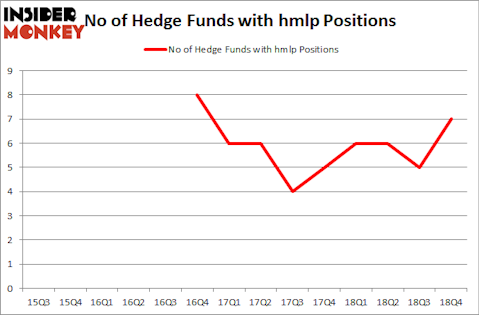

At Q4’s end, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in HMLP over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Hoegh LNG Partners LP (NYSE:HMLP), which was worth $8.5 million at the end of the fourth quarter. On the second spot was Huber Capital Management which amassed $8.4 million worth of shares. Moreover, Prescott Group Capital Management, Marshall Wace LLP, and Millennium Management were also bullish on Hoegh LNG Partners LP (NYSE:HMLP), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in Hoegh LNG Partners LP (NYSE:HMLP). Marshall Wace LLP had $1.3 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also initiated a $0.2 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Hoegh LNG Partners LP (NYSE:HMLP). These stocks are Luther Burbank Corporation (NASDAQ:LBC), Foresight Energy LP (NYSE:FELP), SI-BONE, Inc. (NASDAQ:SIBN), and The First of Long Island Corporation (NASDAQ:FLIC). This group of stocks’ market caps are similar to HMLP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBC | 6 | 27473 | 1 |

| FELP | 3 | 771 | 0 |

| SIBN | 9 | 69929 | 9 |

| FLIC | 9 | 40733 | -3 |

| Average | 6.75 | 34727 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $21 million in HMLP’s case. SI-BONE, Inc. (NASDAQ:SIBN) is the most popular stock in this table. On the other hand Foresight Energy LP (NYSE:FELP) is the least popular one with only 3 bullish hedge fund positions. Hoegh LNG Partners LP (NYSE:HMLP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on HMLP as the stock returned 29.4% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.