Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the fourth quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Hilton Grand Vacations Inc. (NYSE:HGV) changed recently.

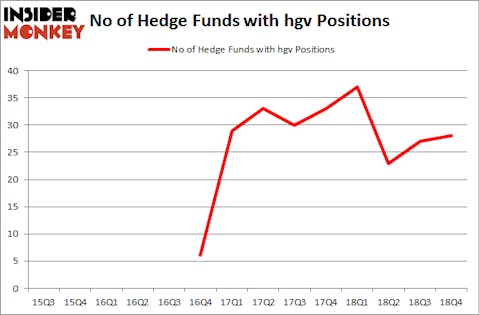

Is Hilton Grand Vacations Inc. (NYSE:HGV) the right investment to pursue these days? Money managers are betting on the stock. The number of long hedge fund positions increased by 1 in recent months. Our calculations also showed that hgv isn’t among the 30 most popular stocks among hedge funds. HGV was in 28 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 27 hedge funds in our database with HGV holdings at the end of the previous quarter.

If you’d ask most stock holders, hedge funds are seen as worthless, old investment tools of the past. While there are more than 8000 funds trading at present, Our experts hone in on the upper echelon of this group, approximately 750 funds. These hedge fund managers administer the lion’s share of the hedge fund industry’s total asset base, and by tailing their top picks, Insider Monkey has discovered a few investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a gander at the new hedge fund action encompassing Hilton Grand Vacations Inc. (NYSE:HGV).

What does the smart money think about Hilton Grand Vacations Inc. (NYSE:HGV)?

At the end of the fourth quarter, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HGV over the last 14 quarters. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Among these funds, Long Pond Capital held the most valuable stake in Hilton Grand Vacations Inc. (NYSE:HGV), which was worth $141.2 million at the end of the third quarter. On the second spot was Highfields Capital Management which amassed $90.1 million worth of shares. Moreover, P2 Capital Partners, Gates Capital Management, and Citadel Investment Group were also bullish on Hilton Grand Vacations Inc. (NYSE:HGV), allocating a large percentage of their portfolios to this stock.

Consequently, specific money managers have been driving this bullishness. Highfields Capital Management, managed by Jonathon Jacobson, assembled the most valuable position in Hilton Grand Vacations Inc. (NYSE:HGV). Highfields Capital Management had $90.1 million invested in the company at the end of the quarter. Claus Moller’s P2 Capital Partners also initiated a $82 million position during the quarter. The following funds were also among the new HGV investors: Richard Mashaal’s Rima Senvest Management, David Einhorn’s Greenlight Capital, and David Rosen’s Rubric Capital Management.

Let’s check out hedge fund activity in other stocks similar to Hilton Grand Vacations Inc. (NYSE:HGV). These stocks are Axon Enterprise, Inc. (NASDAQ:AAXN), Ryder System, Inc. (NYSE:R), NuVasive, Inc. (NASDAQ:NUVA), and RH (NYSE:RH). This group of stocks’ market caps resemble HGV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AAXN | 16 | 228557 | 0 |

| R | 19 | 372942 | -4 |

| NUVA | 20 | 207882 | -2 |

| RH | 28 | 220843 | 0 |

| Average | 20.75 | 257556 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $258 million. That figure was $705 million in HGV’s case. RH (NYSE:RH) is the most popular stock in this table. On the other hand Axon Enterprise, Inc. (NASDAQ:AAXN) is the least popular one with only 16 bullish hedge fund positions. Hilton Grand Vacations Inc. (NYSE:HGV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on HGV as the stock returned 25% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.