Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost more than 25%. Facebook, which was the second most popular stock, lost 20% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the first 2.5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Ecopetrol S.A. (NYSE:EC) has experienced an increase in hedge fund interest in recent months. Our calculations also showed that EC isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the new hedge fund action surrounding Ecopetrol S.A. (NYSE:EC).

What have hedge funds been doing with Ecopetrol S.A. (NYSE:EC)?

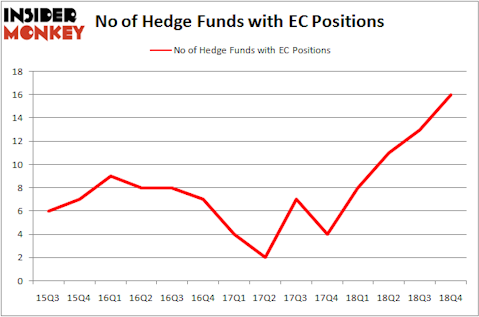

At Q4’s end, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 23% from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in EC a year ago. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Ecopetrol S.A. (NYSE:EC), which was worth $116 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $37 million worth of shares. Moreover, D E Shaw, Millennium Management, and Point72 Asset Management were also bullish on Ecopetrol S.A. (NYSE:EC), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, initiated the most outsized position in Ecopetrol S.A. (NYSE:EC). Point72 Asset Management had $5.2 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $1 million investment in the stock during the quarter. The other funds with brand new EC positions are Ken Heebner’s Capital Growth Management, Dmitry Balyasny’s Balyasny Asset Management, and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks similar to Ecopetrol S.A. (NYSE:EC). These stocks are China Unicom (Hong Kong) Limited (NYSE:CHU), National Grid plc (NYSE:NGG), TransCanada Corporation (NYSE:TRP), and SYSCO Corporation (NYSE:SYY). This group of stocks’ market caps resemble EC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHU | 9 | 60531 | 3 |

| NGG | 10 | 310855 | -1 |

| TRP | 15 | 219002 | 1 |

| SYY | 34 | 2614998 | 3 |

| Average | 17 | 801347 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $801 million. That figure was $193 million in EC’s case. SYSCO Corporation (NYSE:SYY) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (NYSE:CHU) is the least popular one with only 9 bullish hedge fund positions. Ecopetrol S.A. (NYSE:EC) is not the least popular stock in this group but hedge fund interest is still below average. However, hedge fund sentiment is dramatically improving as several hedge funds initiated brand new positions in the stock. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on EC as the stock returned 34.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.