“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Constellium NV (NYSE:CSTM) shareholders have witnessed an increase in enthusiasm from smart money recently. Our calculations also showed that cstm isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are plenty of indicators stock traders can use to evaluate publicly traded companies. Two of the less known indicators are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the top investment managers can outpace the broader indices by a healthy margin (see the details here).

We’re going to take a peek at the fresh hedge fund action regarding Constellium NV (NYSE:CSTM).

How have hedgies been trading Constellium NV (NYSE:CSTM)?

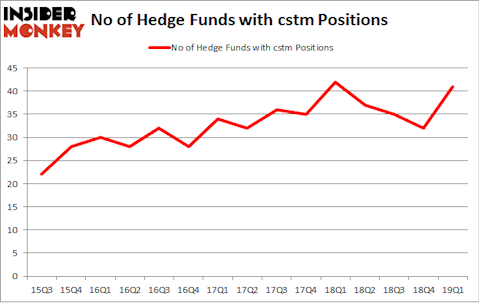

At Q1’s end, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 28% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CSTM over the last 15 quarters. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

The largest stake in Constellium NV (NYSE:CSTM) was held by Nut Tree Capital, which reported holding $26.3 million worth of stock at the end of March. It was followed by Park West Asset Management with a $26.3 million position. Other investors bullish on the company included Kingdon Capital, Rubric Capital Management, and Lonestar Capital Management.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Hudson Bay Capital Management, managed by Sander Gerber, initiated the most outsized position in Constellium NV (NYSE:CSTM). Hudson Bay Capital Management had $3.7 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $3.3 million position during the quarter. The other funds with brand new CSTM positions are Bernard Lambilliotte’s Ecofin Ltd, Charles Davidson and Joseph Jacobs’s Wexford Capital, and Alexander Mitchell’s Scopus Asset Management.

Let’s check out hedge fund activity in other stocks similar to Constellium NV (NYSE:CSTM). These stocks are Neenah Inc. (NYSE:NP), Patrick Industries, Inc. (NASDAQ:PATK), Cryolife Inc (NYSE:CRY), and Universal Insurance Holdings, Inc. (NYSE:UVE). All of these stocks’ market caps match CSTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NP | 7 | 12403 | 3 |

| PATK | 17 | 91534 | -7 |

| CRY | 13 | 25250 | 2 |

| UVE | 13 | 38385 | -7 |

| Average | 12.5 | 41893 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $264 million in CSTM’s case. Patrick Industries, Inc. (NASDAQ:PATK) is the most popular stock in this table. On the other hand Neenah Inc. (NYSE:NP) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Constellium NV (NYSE:CSTM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CSTM as the stock returned 9.3% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.