“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

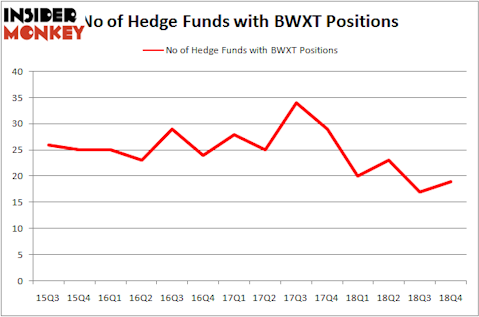

Is BWX Technologies Inc (NYSE:BWXT) the right pick for your portfolio? The smart money is betting on the stock. The number of bullish hedge fund positions moved up by 2 recently. Our calculations also showed that BWXT isn’t among the 30 most popular stocks among hedge funds. BWXT was in 19 hedge funds’ portfolios at the end of December. There were 17 hedge funds in our database with BWXT positions at the end of the previous quarter.

To most investors, hedge funds are seen as slow, old financial tools of yesteryear. While there are over 8000 funds in operation at present, Our experts hone in on the leaders of this group, around 750 funds. Most estimates calculate that this group of people command the lion’s share of all hedge funds’ total capital, and by tailing their first-class stock picks, Insider Monkey has deciphered numerous investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to review the fresh hedge fund action regarding BWX Technologies Inc (NYSE:BWXT).

What does the smart money think about BWX Technologies Inc (NYSE:BWXT)?

At the end of the fourth quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the second quarter of 2018. By comparison, 20 hedge funds held shares or bullish call options in BWXT a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Among these funds, Alkeon Capital Management held the most valuable stake in BWX Technologies Inc (NYSE:BWXT), which was worth $39.1 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $15.5 million worth of shares. Moreover, Ancora Advisors, D E Shaw, and Two Sigma Advisors were also bullish on BWX Technologies Inc (NYSE:BWXT), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers have jumped into BWX Technologies Inc (NYSE:BWXT) headfirst. MSDC Management, managed by Marc Lisker, Glenn Fuhrman and John Phelan, assembled the most valuable position in BWX Technologies Inc (NYSE:BWXT). MSDC Management had $3.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $3.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners, Chuck Royce’s Royce & Associates, and John A. Levin’s Levin Capital Strategies.

Let’s check out hedge fund activity in other stocks similar to BWX Technologies Inc (NYSE:BWXT). We will take a look at Black Hills Corporation (NYSE:BKH), Pegasystems Inc. (NASDAQ:PEGA), Spire Inc. (NYSE:SR), and Methanex Corporation (NASDAQ:MEOH). This group of stocks’ market caps match BWXT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BKH | 17 | 114198 | -2 |

| PEGA | 19 | 527867 | -3 |

| SR | 13 | 90505 | -2 |

| MEOH | 21 | 263929 | 0 |

| Average | 17.5 | 249125 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $249 million. That figure was $86 million in BWXT’s case. Methanex Corporation (NASDAQ:MEOH) is the most popular stock in this table. On the other hand Spire Inc. (NYSE:SR) is the least popular one with only 13 bullish hedge fund positions. BWX Technologies Inc (NYSE:BWXT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on BWXT as the stock returned 35.7% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.