Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

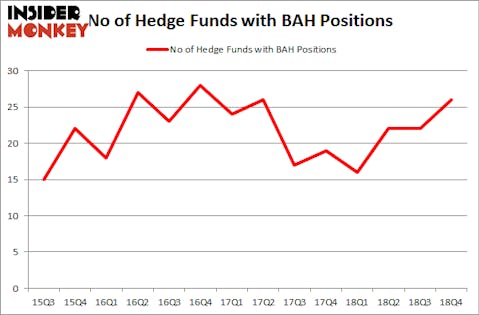

Booz Allen Hamilton Holding Corporation (NYSE:BAH) was in 26 hedge funds’ portfolios at the end of the fourth quarter of 2018. BAH has experienced an increase in hedge fund sentiment recently. There were 22 hedge funds in our database with BAH holdings at the end of the previous quarter. Our calculations also showed that BAH isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s analyze the recent hedge fund action regarding Booz Allen Hamilton Holding Corporation (NYSE:BAH).

What have hedge funds been doing with Booz Allen Hamilton Holding Corporation (NYSE:BAH)?

Heading into the first quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the second quarter of 2018. On the other hand, there were a total of 16 hedge funds with a bullish position in BAH a year ago. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, holds the most valuable position in Booz Allen Hamilton Holding Corporation (NYSE:BAH). Polar Capital has a $72.5 million position in the stock, comprising 0.8% of its 13F portfolio. The second most bullish fund manager is AQR Capital Management, led by Cliff Asness, holding a $52.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other peers with similar optimism include Israel Englander’s Millennium Management, Joel Greenblatt’s Gotham Asset Management and John Overdeck and David Siegel’s Two Sigma Advisors.

As aggregate interest increased, specific money managers have been driving this bullishness. Gotham Asset Management, managed by Joel Greenblatt, initiated the biggest position in Booz Allen Hamilton Holding Corporation (NYSE:BAH). Gotham Asset Management had $13.8 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $2.8 million investment in the stock during the quarter. The other funds with brand new BAH positions are David Costen Haley’s HBK Investments, Matthew Tewksbury’s Stevens Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Booz Allen Hamilton Holding Corporation (NYSE:BAH). We will take a look at Gerdau SA (NYSE:GGB), The Madison Square Garden Company (NYSE:MSG), Kilroy Realty Corp (NYSE:KRC), and Santander Consumer USA Holdings Inc (NYSE:SC). This group of stocks’ market valuations resemble BAH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GGB | 12 | 143342 | -3 |

| MSG | 46 | 1733627 | 6 |

| KRC | 13 | 178217 | 1 |

| SC | 21 | 565375 | -5 |

| Average | 23 | 655140 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $655 million. That figure was $216 million in BAH’s case. The Madison Square Garden Company (NYSE:MSG) is the most popular stock in this table. On the other hand Gerdau SA (NYSE:GGB) is the least popular one with only 12 bullish hedge fund positions. Booz Allen Hamilton Holding Corporation (NYSE:BAH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on BAH as the stock returned 30% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.