The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at AutoZone, Inc. (NYSE:AZO) from the perspective of those elite funds.

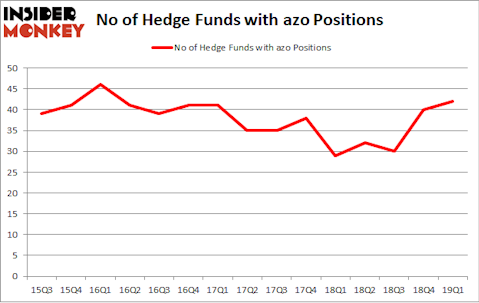

AutoZone, Inc. (NYSE:AZO) was in 42 hedge funds’ portfolios at the end of the first quarter of 2019. AZO shareholders have witnessed an increase in enthusiasm from smart money recently. There were 40 hedge funds in our database with AZO positions at the end of the previous quarter. Our calculations also showed that azo isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Cliff Asness of AQR Capital Management

Let’s take a glance at the recent hedge fund action encompassing AutoZone, Inc. (NYSE:AZO).

How are hedge funds trading AutoZone, Inc. (NYSE:AZO)?

At Q1’s end, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in AZO a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’s AQR Capital Management has the number one position in AutoZone, Inc. (NYSE:AZO), worth close to $207.7 million, corresponding to 0.2% of its total 13F portfolio. The second most bullish fund manager is John Overdeck and David Siegel of Two Sigma Advisors, with a $180.8 million position; 0.5% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish encompass Ken Griffin’s Citadel Investment Group, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Brandon Haley’s Holocene Advisors.

As industrywide interest jumped, specific money managers have jumped into AutoZone, Inc. (NYSE:AZO) headfirst. Junto Capital Management, managed by James Parsons, initiated the biggest position in AutoZone, Inc. (NYSE:AZO). Junto Capital Management had $38.5 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also made a $31.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Bain Capital’s Brookside Capital, Anthony Joseph Vaccarino’s North Fourth Asset Management, and Louis Navellier’s Navellier & Associates.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as AutoZone, Inc. (NYSE:AZO) but similarly valued. We will take a look at Tyson Foods, Inc. (NYSE:TSN), Twitter Inc (NYSE:TWTR), Spotify Technology S.A. (NYSE:SPOT), and CRH PLC (NYSE:CRH). This group of stocks’ market values resemble AZO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSN | 43 | 1534989 | 5 |

| TWTR | 46 | 1363199 | -3 |

| SPOT | 53 | 2210192 | 8 |

| CRH | 5 | 60693 | -3 |

| Average | 36.75 | 1292268 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.75 hedge funds with bullish positions and the average amount invested in these stocks was $1292 million. That figure was $1209 million in AZO’s case. Spotify Technology S.A. (NYSE:SPOT) is the most popular stock in this table. On the other hand CRH PLC (NYSE:CRH) is the least popular one with only 5 bullish hedge fund positions. AutoZone, Inc. (NYSE:AZO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on AZO as the stock returned 2.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.