“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Fitbit Inc (NYSE:FIT).

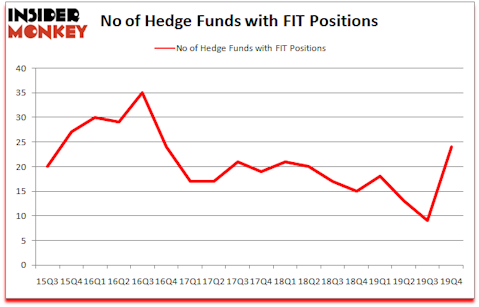

Is Fitbit Inc (NYSE:FIT) a buy here? Hedge funds are becoming more confident. The number of long hedge fund bets inched up by 15 in recent months. Our calculations also showed that FIT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). FIT was in 24 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with FIT holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Prem Watsa of Fairfax Financial Holdings

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a look at the recent hedge fund action encompassing Fitbit Inc (NYSE:FIT).

What have hedge funds been doing with Fitbit Inc (NYSE:FIT)?

Heading into the first quarter of 2020, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 167% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards FIT over the last 18 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Alec Litowitz and Ross Laser’s Magnetar Capital has the biggest position in Fitbit Inc (NYSE:FIT), worth close to $80.3 million, comprising 1.7% of its total 13F portfolio. The second most bullish fund is Renaissance Technologies, with a $44.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions consist of Matthew Mark’s Jet Capital Investors, Matthew Halbower’s Pentwater Capital Management and Prem Watsa’s Fairfax Financial Holdings. In terms of the portfolio weights assigned to each position Jet Capital Investors allocated the biggest weight to Fitbit Inc (NYSE:FIT), around 6.32% of its 13F portfolio. Magnetar Capital is also relatively very bullish on the stock, earmarking 1.68 percent of its 13F equity portfolio to FIT.

Consequently, some big names have jumped into Fitbit Inc (NYSE:FIT) headfirst. Magnetar Capital, managed by Alec Litowitz and Ross Laser, created the biggest position in Fitbit Inc (NYSE:FIT). Magnetar Capital had $80.3 million invested in the company at the end of the quarter. Matthew Halbower’s Pentwater Capital Management also made a $24.1 million investment in the stock during the quarter. The other funds with brand new FIT positions are Prem Watsa’s Fairfax Financial Holdings, Michel Massoud’s Melqart Asset Management, and Michael Kharitonov and Jon David McAuliffe’s Voleon Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Fitbit Inc (NYSE:FIT) but similarly valued. These stocks are Central Garden & Pet Co (NASDAQ:CENT), Veoneer, Inc. (NYSE:VNE), The Cheesecake Factory Incorporated (NASDAQ:CAKE), and Heartland Express, Inc. (NASDAQ:HTLD). This group of stocks’ market values match FIT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CENT | 17 | 130671 | -8 |

| VNE | 11 | 150991 | 0 |

| CAKE | 27 | 87474 | 3 |

| HTLD | 14 | 22928 | -4 |

| Average | 17.25 | 98016 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $98 million. That figure was $209 million in FIT’s case. The Cheesecake Factory Incorporated (NASDAQ:CAKE) is the most popular stock in this table. On the other hand Veoneer, Inc. (NYSE:VNE) is the least popular one with only 11 bullish hedge fund positions. Fitbit Inc (NYSE:FIT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. Hedge funds were also right about betting on FIT as the stock returned -1.1% in 2020 (through April 6th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.