Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether ePlus Inc. (NASDAQ:PLUS) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

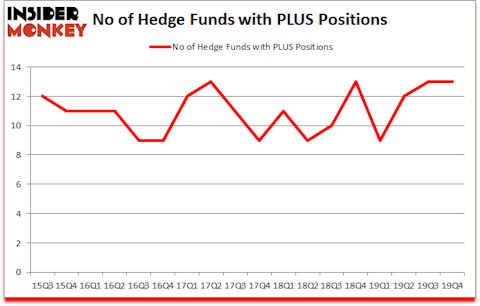

ePlus Inc. (NASDAQ:PLUS) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 13 hedge funds’ portfolios at the end of December. At the end of this article we will also compare PLUS to other stocks including Mr. Cooper Group Inc. (NASDAQ:COOP), BBVA Banco Frances S.A. (NYSE:BBAR), and Signet Jewelers Limited (NYSE:SIG) to get a better sense of its popularity.

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with 77% accuracy, so we check out his stock picks. A former hedge fund manager is pitching the “next Amazon” in this video; again we are listening. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s analyze the fresh hedge fund action regarding ePlus Inc. (NASDAQ:PLUS).

What does smart money think about ePlus Inc. (NASDAQ:PLUS)?

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the third quarter of 2019. By comparison, 13 hedge funds held shares or bullish call options in PLUS a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in ePlus Inc. (NASDAQ:PLUS) was held by D E Shaw, which reported holding $10.8 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $9.9 million position. Other investors bullish on the company included AQR Capital Management, Millennium Management, and Algert Coldiron Investors. In terms of the portfolio weights assigned to each position Algert Coldiron Investors allocated the biggest weight to ePlus Inc. (NASDAQ:PLUS), around 0.78% of its 13F portfolio. Zebra Capital Management is also relatively very bullish on the stock, dishing out 0.43 percent of its 13F equity portfolio to PLUS.

Because ePlus Inc. (NASDAQ:PLUS) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there were a few fund managers that elected to cut their entire stakes last quarter. At the top of the heap, Chuck Royce’s Royce & Associates said goodbye to the biggest stake of the 750 funds followed by Insider Monkey, worth an estimated $2.3 million in stock, and Michael Gelband’s ExodusPoint Capital was right behind this move, as the fund said goodbye to about $0.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as ePlus Inc. (NASDAQ:PLUS) but similarly valued. These stocks are Mr. Cooper Group Inc. (NASDAQ:COOP), BBVA Banco Frances S.A. (NYSE:BBAR), Signet Jewelers Limited (NYSE:SIG), and Revlon Inc (NYSE:REV). This group of stocks’ market valuations are closest to PLUS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COOP | 23 | 280344 | -2 |

| BBAR | 9 | 14546 | -1 |

| SIG | 22 | 188502 | 5 |

| REV | 38 | 291977 | 3 |

| Average | 23 | 193842 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $194 million. That figure was $45 million in PLUS’s case. Revlon Inc (NYSE:REV) is the most popular stock in this table. On the other hand BBVA Banco Frances S.A. (NYSE:BBAR) is the least popular one with only 9 bullish hedge fund positions. ePlus Inc. (NASDAQ:PLUS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. Unfortunately PLUS wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); PLUS investors were disappointed as the stock returned -17.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.