Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Insulet Corporation (NASDAQ:PODD)? The smart money sentiment can provide an answer to this question.

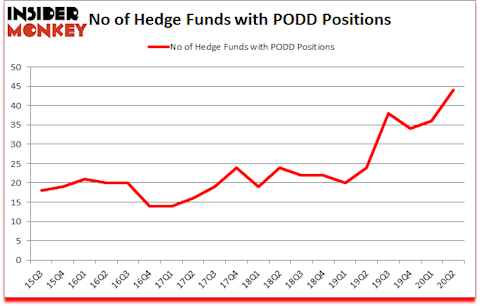

Insulet Corporation (NASDAQ:PODD) shareholders have witnessed an increase in hedge fund interest in recent months. Insulet Corporation (NASDAQ:PODD) was in 44 hedge funds’ portfolios at the end of June. The all time high for this statistics is 38. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 36 hedge funds in our database with PODD holdings at the end of March. Our calculations also showed that PODD isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Kris Jenner of Rock Springs Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now we’re going to analyze the fresh hedge fund action surrounding Insulet Corporation (NASDAQ:PODD).

How have hedgies been trading Insulet Corporation (NASDAQ:PODD)?

At the end of June, a total of 44 of the hedge funds tracked by Insider Monkey were long this stock, a change of 22% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PODD over the last 20 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Coatue Management held the most valuable stake in Insulet Corporation (NASDAQ:PODD), which was worth $282.5 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $95.3 million worth of shares. Holocene Advisors, Citadel Investment Group, and Rock Springs Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Think Investments allocated the biggest weight to Insulet Corporation (NASDAQ:PODD), around 8.71% of its 13F portfolio. Coatue Management is also relatively very bullish on the stock, designating 2.49 percent of its 13F equity portfolio to PODD.

As aggregate interest increased, key money managers were breaking ground themselves. Holocene Advisors, managed by Brandon Haley, initiated the most outsized position in Insulet Corporation (NASDAQ:PODD). Holocene Advisors had $94.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $21.3 million position during the quarter. The other funds with new positions in the stock are Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management, Bhagwan Jay Rao’s Integral Health Asset Management, and Greg Martinez’s Parkman Healthcare Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Insulet Corporation (NASDAQ:PODD) but similarly valued. We will take a look at J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT), Expeditors International of Washington, Inc. (NASDAQ:EXPD), Qorvo Inc (NASDAQ:QRVO), Etsy Inc (NASDAQ:ETSY), Genuine Parts Company (NYSE:GPC), Sarepta Therapeutics Inc (NASDAQ:SRPT), and Hewlett Packard Enterprise Company (NYSE:HPE). All of these stocks’ market caps match PODD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JBHT | 24 | 215950 | -1 |

| EXPD | 33 | 443457 | 2 |

| QRVO | 51 | 1608774 | 12 |

| ETSY | 43 | 1727421 | 5 |

| GPC | 20 | 144284 | -2 |

| SRPT | 39 | 1148135 | 6 |

| HPE | 31 | 693633 | 2 |

| Average | 34.4 | 854522 | 3.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.4 hedge funds with bullish positions and the average amount invested in these stocks was $855 million. That figure was $985 million in PODD’s case. Qorvo Inc (NASDAQ:QRVO) is the most popular stock in this table. On the other hand Genuine Parts Company (NYSE:GPC) is the least popular one with only 20 bullish hedge fund positions. Insulet Corporation (NASDAQ:PODD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PODD is 78.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and still beat the market by 21 percentage points. Hedge funds were also right about betting on PODD as the stock returned 28.4% since the end of Q2 (through 10/23) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Insulet Corp (NASDAQ:PODD)

Follow Insulet Corp (NASDAQ:PODD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.