Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards CVS Health Corporation (NYSE:CVS).

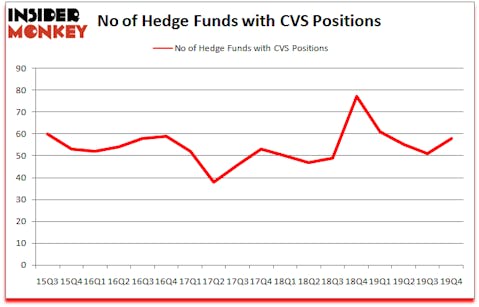

Is CVS Health Corporation (NYSE:CVS) an outstanding investment today? Prominent investors are betting on the stock. The number of bullish hedge fund positions increased by 7 in recent months. Our calculations also showed that CVS isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

To most traders, hedge funds are seen as worthless, old financial vehicles of years past. While there are more than 8000 funds with their doors open today, Our researchers look at the crème de la crème of this group, approximately 850 funds. Most estimates calculate that this group of people have their hands on the majority of all hedge funds’ total capital, and by tracking their highest performing stock picks, Insider Monkey has brought to light numerous investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Bruce Kovner of Caxton Associates LP

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a glance at the new hedge fund action encompassing CVS Health Corporation (NYSE:CVS).

What does smart money think about CVS Health Corporation (NYSE:CVS)?

Heading into the first quarter of 2020, a total of 58 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards CVS over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in CVS Health Corporation (NYSE:CVS) was held by Citadel Investment Group, which reported holding $134.5 million worth of stock at the end of September. It was followed by Adage Capital Management with a $112.6 million position. Other investors bullish on the company included D E Shaw, Citadel Investment Group, and Millennium Management. In terms of the portfolio weights assigned to each position Healthcare Value Capital allocated the biggest weight to CVS Health Corporation (NYSE:CVS), around 10.94% of its 13F portfolio. Masters Capital Management is also relatively very bullish on the stock, dishing out 4.02 percent of its 13F equity portfolio to CVS.

Consequently, specific money managers have jumped into CVS Health Corporation (NYSE:CVS) headfirst. Hudson Bay Capital Management, managed by Sander Gerber, created the largest position in CVS Health Corporation (NYSE:CVS). Hudson Bay Capital Management had $27.1 million invested in the company at the end of the quarter. Michael Rockefeller and Karl Kroeker’s Woodline Partners also made a $11.8 million investment in the stock during the quarter. The other funds with brand new CVS positions are Bhagwan Jay Rao’s Integral Health Asset Management, Bruce Kovner’s Caxton Associates LP, and Ali Motamed’s Invenomic Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as CVS Health Corporation (NYSE:CVS) but similarly valued. These stocks are Altria Group Inc (NYSE:MO), U.S. Bancorp (NYSE:USB), Lowe’s Companies, Inc. (NYSE:LOW), and Booking Holdings Inc. (NASDAQ:BKNG). This group of stocks’ market valuations resemble CVS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MO | 54 | 1750020 | 1 |

| USB | 50 | 8686368 | 3 |

| LOW | 77 | 5412801 | 1 |

| BKNG | 74 | 5578745 | -13 |

| Average | 63.75 | 5356984 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 63.75 hedge funds with bullish positions and the average amount invested in these stocks was $5357 million. That figure was $969 million in CVS’s case. Lowe’s Companies, Inc. (NYSE:LOW) is the most popular stock in this table. On the other hand U.S. Bancorp (NYSE:USB) is the least popular one with only 50 bullish hedge fund positions. CVS Health Corporation (NYSE:CVS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but beat the market by 11 percentage points. Unfortunately CVS wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); CVS investors were disappointed as the stock returned -15.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.