While the market driven by short-term sentiment influenced by the accommodative interest rate environment in the US, virus news and stimulus spending, many smart money investors are starting to get cautious towards the current bull run since March and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Crown Castle International Corp. (REIT) (NYSE:CCI).

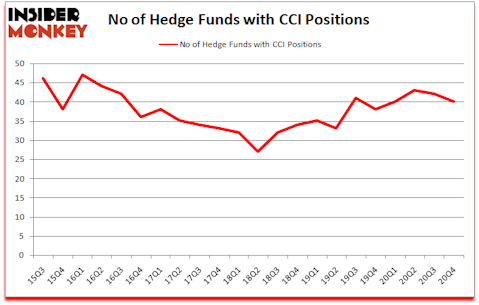

Is Crown Castle International Corp. (REIT) (NYSE:CCI) a buy here? The best stock pickers were becoming less hopeful. The number of long hedge fund positions retreated by 2 lately. Crown Castle International Corp. (REIT) (NYSE:CCI) was in 40 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 47. Our calculations also showed that CCI isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings). There were 42 hedge funds in our database with CCI positions at the end of the third quarter.

In the financial world there are several signals shareholders have at their disposal to assess stocks. Two of the most useful signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best investment managers can outperform the market by a solid margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

Stuart Zimmer of Zimmer Partners

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to go over the new hedge fund action regarding Crown Castle International Corp. (REIT) (NYSE:CCI).

Do Hedge Funds Think CCI Is A Good Stock To Buy Now?

At fourth quarter’s end, a total of 40 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the third quarter of 2020. On the other hand, there were a total of 38 hedge funds with a bullish position in CCI a year ago. With hedge funds’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Bill & Melinda Gates Foundation Trust was the largest shareholder of Crown Castle International Corp. (REIT) (NYSE:CCI), with a stake worth $848.9 million reported as of the end of December. Trailing Bill & Melinda Gates Foundation Trust was Fisher Asset Management, which amassed a stake valued at $336.9 million. Citadel Investment Group, D E Shaw, and Echo Street Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Courage Capital allocated the biggest weight to Crown Castle International Corp. (REIT) (NYSE:CCI), around 8.41% of its 13F portfolio. Skylands Capital is also relatively very bullish on the stock, dishing out 7.45 percent of its 13F equity portfolio to CCI.

Since Crown Castle International Corp. (REIT) (NYSE:CCI) has faced bearish sentiment from the smart money, we can see that there exists a select few funds that elected to cut their entire stakes in the fourth quarter. Intriguingly, Jaime Sterne’s Skye Global Management dumped the biggest stake of all the hedgies followed by Insider Monkey, comprising about $32.6 million in stock. Jonathan Litt’s fund, Land & Buildings Investment Management, also dumped its stock, about $26.2 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 2 funds in the fourth quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Crown Castle International Corp. (REIT) (NYSE:CCI) but similarly valued. We will take a look at Lam Research Corporation (NASDAQ:LRCX), Duke Energy Corporation (NYSE:DUK), Autodesk, Inc. (NASDAQ:ADSK), The Sherwin-Williams Company (NYSE:SHW), The Bank of Nova Scotia (NYSE:BNS), CME Group Inc (NASDAQ:CME), and NetEase, Inc (NASDAQ:NTES). This group of stocks’ market valuations are similar to CCI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LRCX | 56 | 2619776 | 1 |

| DUK | 38 | 614751 | 2 |

| ADSK | 66 | 3528315 | 1 |

| SHW | 49 | 1881345 | -6 |

| BNS | 19 | 336708 | 5 |

| CME | 58 | 2275518 | -1 |

| NTES | 38 | 3467820 | -7 |

| Average | 46.3 | 2103462 | -0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 46.3 hedge funds with bullish positions and the average amount invested in these stocks was $2103 million. That figure was $2072 million in CCI’s case. Autodesk, Inc. (NASDAQ:ADSK) is the most popular stock in this table. On the other hand The Bank of Nova Scotia (NYSE:BNS) is the least popular one with only 19 bullish hedge fund positions. Crown Castle International Corp. (REIT) (NYSE:CCI) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for CCI is 50.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on CCI as the stock returned 19.8% since the end of the fourth quarter (through 4/30) and outperformed the market by an even larger margin.

Follow Crown Castle Inc. (NYSE:CCI)

Follow Crown Castle Inc. (NYSE:CCI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.