We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Tapestry, Inc. (NYSE:TPR).

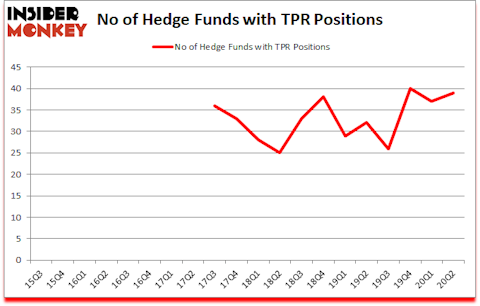

Tapestry, Inc. (NYSE:TPR) has seen an increase in enthusiasm from smart money of late. Tapestry, Inc. (NYSE:TPR) was in 39 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 40. There were 37 hedge funds in our database with TPR positions at the end of the first quarter. Our calculations also showed that TPR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Robert Pohly of Samlyn Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Our analysis determined that presidential election polls were wrong heading into the 2020 election and we were able to make the most accurate predictions in the country after making adjustments for the biases in existing polls. For example we predicted comfortable Trump victories in Florida, North Carolina, Texas, Iowa, and Ohio. We also predicted a very narrow Biden victory of 0.4 points in Wisconsin when most pollsters were predicting 8 to 10 points Biden victories. We are waiting for the results of 5 more states, but our accuracy rate so far is 100% (see our predictions). You can subscribe to our free daily newsletter on our website to get email alerts whenever we publish an interesting article. Now let’s take a look at the key hedge fund action regarding Tapestry, Inc. (NYSE:TPR).

What does smart money think about Tapestry, Inc. (NYSE:TPR)?

Heading into the third quarter of 2020, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the previous quarter. On the other hand, there were a total of 32 hedge funds with a bullish position in TPR a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the most valuable position in Tapestry, Inc. (NYSE:TPR). Citadel Investment Group has a $108.7 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is Samlyn Capital, led by Robert Pohly, holding a $68.2 million position; 1.3% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism contain David Fear’s Thunderbird Partners, Jacob Mitchell’s Antipodes Partners and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Thunderbird Partners allocated the biggest weight to Tapestry, Inc. (NYSE:TPR), around 7.24% of its 13F portfolio. Prentice Capital Management is also relatively very bullish on the stock, dishing out 4.27 percent of its 13F equity portfolio to TPR.

Now, specific money managers have been driving this bullishness. Thunderbird Partners, managed by David Fear, assembled the largest position in Tapestry, Inc. (NYSE:TPR). Thunderbird Partners had $50.8 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $38.7 million investment in the stock during the quarter. The following funds were also among the new TPR investors: Ricky Sandler’s Eminence Capital, Michael Zimmerman’s Prentice Capital Management, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Tapestry, Inc. (NYSE:TPR) but similarly valued. These stocks are Simpson Manufacturing Co, Inc. (NYSE:SSD), Alamos Gold Inc (NYSE:AGI), DouYu International Holdings Limited (NASDAQ:DOYU), Momo Inc (NASDAQ:MOMO), Cogent Communications Holdings Inc. (NASDAQ:CCOI), Parsons Corporation (NYSE:PSN), and Texas Roadhouse Inc (NASDAQ:TXRH). All of these stocks’ market caps are closest to TPR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSD | 21 | 200223 | -5 |

| AGI | 16 | 399028 | -3 |

| DOYU | 15 | 77638 | 0 |

| MOMO | 34 | 586169 | 9 |

| CCOI | 28 | 464857 | 1 |

| PSN | 15 | 81243 | 0 |

| TXRH | 25 | 233801 | -2 |

| Average | 22 | 291851 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $292 million. That figure was $533 million in TPR’s case. Momo Inc (NASDAQ:MOMO) is the most popular stock in this table. On the other hand DouYu International Holdings Limited (NASDAQ:DOYU) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Tapestry, Inc. (NYSE:TPR) is more popular among hedge funds. Our overall hedge fund sentiment score for TPR is 86.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 23% in 2020 through October 30th but still managed to beat the market by 20.1 percentage points. Hedge funds were also right about betting on TPR as the stock returned 67.4% since the end of June (through 10/30) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Tapestry Inc. (NYSE:TPR)

Follow Tapestry Inc. (NYSE:TPR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.