Technology stocks had a lousy start to 2022. QQQ lost 9% of its value in January. Pandemic winners are getting crushed while energy stocks are surging. Roblox lost 36%, Moderna lost 33%, and Carvana and Shopify lost 30% of their values in January. We aren’t certain about the bubbly technology stocks that trade for ridiculously high multiples of their revenues, but we believe top hedge fund stocks will deliver positive returns for the rest of the year. In this article, we will take a closer look at hedge fund sentiment towards CONX Corp. (NASDAQ:CONX) at the end of the third quarter and determine whether the smart money was really smart about this stock.

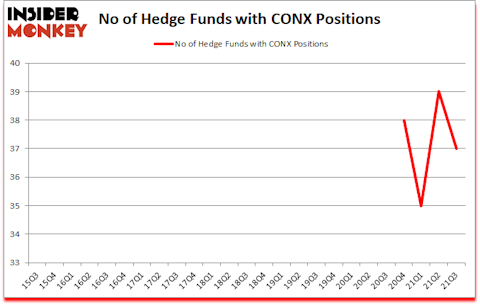

CONX Corp. (NASDAQ:CONX) investors should pay attention to a decrease in activity from the world’s largest hedge funds lately. CONX Corp. (NASDAQ:CONX) was in 37 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 39. Our calculations also showed that CONX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

Paul Marshall of Marshall Wace

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to analyze the key hedge fund action regarding CONX Corp. (NASDAQ:CONX).

Do Hedge Funds Think CONX Is A Good Stock To Buy Now?

At Q3’s end, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in CONX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Jericho Capital Asset Management held the most valuable stake in CONX Corp. (NASDAQ:CONX) , which was worth $39.2 million at the end of the third quarter. On the second spot was Magnetar Capital which amassed $38.2 million worth of shares. Glazer Capital, Marshall Wace LLP, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Fort Baker Capital Management allocated the biggest weight to CONX Corp. (NASDAQ:CONX) , around 4.75% of its 13F portfolio. Discovery Capital Management is also relatively very bullish on the stock, earmarking 1.69 percent of its 13F equity portfolio to CONX.

Seeing as CONX Corp. (NASDAQ:CONX) has witnessed falling interest from the smart money, it’s easy to see that there exists a select few hedgies that elected to cut their entire stakes last quarter. Intriguingly, Himanshu Gulati’s Antara Capital dumped the largest stake of all the hedgies monitored by Insider Monkey, valued at close to $4.9 million in stock, and Doug Silverman and Alexander Klabin’s Senator Investment Group was right behind this move, as the fund sold off about $1.2 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as CONX Corp. (NASDAQ:CONX) but similarly valued. These stocks are Funko, Inc. (NASDAQ:FNKO), Washington Trust Bancorp (NASDAQ:WASH), Heritage Financial Corporation (NASDAQ:HFWA), Ellington Financial Inc. (NYSE:EFC), Electric Last Mile Solutions Inc. (NASDAQ:ELMS), Alta Mesa Resources, Inc. (NASDAQ:AMR), and TransMedics Group, Inc. (NASDAQ:TMDX). This group of stocks’ market valuations match CONX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNKO | 18 | 155986 | -1 |

| WASH | 5 | 18363 | -4 |

| HFWA | 10 | 20945 | 2 |

| EFC | 10 | 58995 | 3 |

| ELMS | 13 | 6645 | 13 |

| AMR | 19 | 209813 | 0 |

| TMDX | 5 | 5127 | -3 |

| Average | 11.4 | 67982 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.4 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $408 million in CONX’s case. Alta Mesa Resources, Inc. (NASDAQ:AMR) is the most popular stock in this table. On the other hand Washington Trust Bancorp (NASDAQ:WASH) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks CONX Corp. (NASDAQ:CONX) is more popular among hedge funds. Our overall hedge fund sentiment score for CONX is 81.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still managed to beat the market by another 3.6 percentage points. Hedge funds were somewhat right about betting on CONX as the stock returned 0% since the end of September (through January 31st) and outperformed the top 5 hedge fund stocks but not the market. This is a rare phenomenon as top hedge fund stocks usually beat the market over the long-term.

Follow Conx Corp. (NASDAQ:CONX)

Follow Conx Corp. (NASDAQ:CONX)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 10 Cloud Computing Stocks To Buy

- 25 Biggest Questions In Science

- Top 10 Places to Go as Soon as Coronavirus Pandemic Ends

Disclosure: None. This article was originally published at Insider Monkey.