We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Caterpillar Inc. (NYSE:CAT).

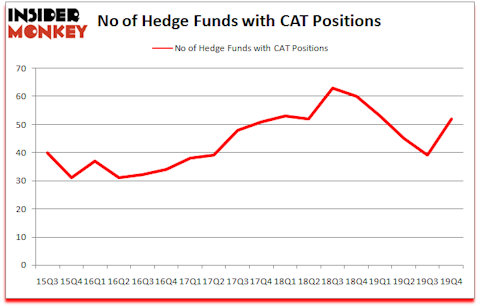

Is Caterpillar Inc. (NYSE:CAT) a safe investment today? Hedge funds are in an optimistic mood. The number of bullish hedge fund bets moved up by 13 in recent months. Our calculations also showed that CAT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

If you’d ask most stock holders, hedge funds are seen as underperforming, old financial tools of yesteryear. While there are greater than 8000 funds trading at present, Our researchers hone in on the bigwigs of this club, approximately 850 funds. These hedge fund managers control most of all hedge funds’ total asset base, and by paying attention to their best investments, Insider Monkey has come up with various investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Jonathan Barrett of Luminus Management

Keeping this in mind let’s check out the latest hedge fund action surrounding Caterpillar Inc. (NYSE:CAT).

How have hedgies been trading Caterpillar Inc. (NYSE:CAT)?

At Q4’s end, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CAT over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Bill & Melinda Gates Foundation Trust held the most valuable stake in Caterpillar Inc. (NYSE:CAT), which was worth $1663 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $819.2 million worth of shares. Citadel Investment Group, Adage Capital Management, and Alyeska Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Bill & Melinda Gates Foundation Trust allocated the biggest weight to Caterpillar Inc. (NYSE:CAT), around 7.79% of its 13F portfolio. Bronson Point Partners is also relatively very bullish on the stock, dishing out 4.02 percent of its 13F equity portfolio to CAT.

Consequently, key money managers have been driving this bullishness. Scopus Asset Management, managed by Alexander Mitchell, created the most outsized position in Caterpillar Inc. (NYSE:CAT). Scopus Asset Management had $21.6 million invested in the company at the end of the quarter. Michael Cowley’s Sandbar Asset Management also made a $11.9 million investment in the stock during the quarter. The other funds with brand new CAT positions are Sara Nainzadeh’s Centenus Global Management, Gregg Moskowitz’s Interval Partners, and Jonathan Barrett and Paul Segal’s Luminus Management.

Let’s also examine hedge fund activity in other stocks similar to Caterpillar Inc. (NYSE:CAT). These stocks are The Goldman Sachs Group, Inc. (NYSE:GS), Enbridge Inc (NYSE:ENB), Mondelez International Inc (NASDAQ:MDLZ), and Fiserv, Inc. (NASDAQ:FISV). This group of stocks’ market values are closest to CAT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GS | 75 | 7581397 | -3 |

| ENB | 21 | 285809 | 1 |

| MDLZ | 50 | 2343152 | -6 |

| FISV | 78 | 4174064 | -2 |

| Average | 56 | 3596106 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 56 hedge funds with bullish positions and the average amount invested in these stocks was $3596 million. That figure was $3228 million in CAT’s case. Fiserv, Inc. (NASDAQ:FISV) is the most popular stock in this table. On the other hand Enbridge Inc (NYSE:ENB) is the least popular one with only 21 bullish hedge fund positions. Caterpillar Inc. (NYSE:CAT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. Unfortunately CAT wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); CAT investors were disappointed as the stock returned -23.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.