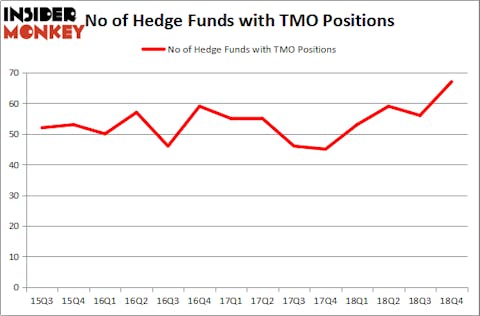

Is Thermo Fisher Scientific Inc. (NYSE:TMO) an outstanding investment now? Prominent investors are becoming hopeful. The number of bullish hedge fund bets advanced by 11 in recent months. Our calculations showed that TMO isn’t among the 30 most popular stocks among hedge funds, however, overall hedge fund sentiment towards the stock is at an all time high.

This is usually a very bullish signal. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed a similar performance from Progressive Corporation (PGR) which returned 27% and outperformed the SPY by nearly 14 percentage points in 2.5 months. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL, and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

In the eyes of most traders, hedge funds are viewed as slow, outdated financial tools of years past. While there are greater than 8000 funds trading at present, We hone in on the masters of this club, about 750 funds. These investment experts preside over the lion’s share of all hedge funds’ total asset base, and by tracking their matchless picks, Insider Monkey has come up with various investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the recent hedge fund action regarding Thermo Fisher Scientific Inc. (NYSE:TMO).

How have hedgies been trading Thermo Fisher Scientific Inc. (NYSE:TMO)?

At Q4’s end, a total of 67 of the hedge funds tracked by Insider Monkey were long this stock, a change of 20% from the previous quarter. On the other hand, there were a total of 53 hedge funds with a bullish position in TMO a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

More specifically, Generation Investment Management was the largest shareholder of Thermo Fisher Scientific Inc. (NYSE:TMO), with a stake worth $675.5 million reported as of the end of September. Trailing Generation Investment Management was AQR Capital Management, which amassed a stake valued at $428.7 million. Glenview Capital, Select Equity Group, and Cantillon Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers were breaking ground themselves. Eminence Capital, managed by Ricky Sandler, established the largest position in Thermo Fisher Scientific Inc. (NYSE:TMO). Eminence Capital had $127.9 million invested in the company at the end of the quarter. Arthur B Cohen and Joseph Healey’s Healthcor Management LP also initiated a $113.9 million position during the quarter. The following funds were also among the new TMO investors: Christopher James’s Partner Fund Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and James Crichton’s Hitchwood Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Thermo Fisher Scientific Inc. (NYSE:TMO). These stocks are Costco Wholesale Corporation (NASDAQ:COST), Itau Unibanco Holding SA (NYSE:ITUB), Twenty-First Century Fox Inc (NASDAQ:FOX), and Linde plc (NYSE:LIN). This group of stocks’ market caps are similar to TMO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COST | 48 | 3254890 | 9 |

| ITUB | 18 | 1032674 | 3 |

| FOX | 44 | 5266521 | -5 |

| LIN | 37 | 1618098 | 37 |

| Average | 36.75 | 2793046 | 11 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.75 hedge funds with bullish positions and the average amount invested in these stocks was $2793 million. That figure was $3830 million in TMO’s case. Costco Wholesale Corporation (NASDAQ:COST) is the most popular stock in this table. On the other hand Itau Unibanco Holding SA (NYSE:ITUB) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Thermo Fisher Scientific Inc. (NYSE:TMO) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on TMO as the stock returned 17.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.