At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

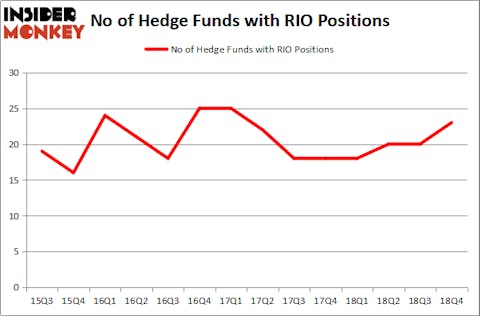

Is Rio Tinto Group (NYSE:RIO) a healthy stock for your portfolio? The best stock pickers are getting more bullish. The number of long hedge fund positions rose by 3 lately. Our calculations also showed that RIO isn’t among the 30 most popular stocks among hedge funds. RIO was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 20 hedge funds in our database with RIO positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to check out the new hedge fund action encompassing Rio Tinto Group (NYSE:RIO).

How have hedgies been trading Rio Tinto Group (NYSE:RIO)?

At Q4’s end, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 15% from the second quarter of 2018. On the other hand, there were a total of 18 hedge funds with a bullish position in RIO a year ago. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the largest position in Rio Tinto Group (NYSE:RIO). Fisher Asset Management has a $459.9 million position in the stock, comprising 0.6% of its 13F portfolio. The second most bullish fund manager is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $307.6 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Other peers with similar optimism include Robert Bishop’s Impala Asset Management, John Overdeck and David Siegel’s Two Sigma Advisors and Jacob Doft’s Highline Capital Management.

Consequently, some big names were leading the bulls’ herd. Highline Capital Management, managed by Jacob Doft, assembled the biggest position in Rio Tinto Group (NYSE:RIO). Highline Capital Management had $32.1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $30.6 million investment in the stock during the quarter. The following funds were also among the new RIO investors: D. E. Shaw’s D E Shaw, Lee Ainslie’s Maverick Capital, and Sara Nainzadeh’s Centenus Global Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Rio Tinto Group (NYSE:RIO) but similarly valued. These stocks are NVIDIA Corporation (NASDAQ:NVDA), American Express Company (NYSE:AXP), Gilead Sciences, Inc. (NASDAQ:GILD), and Starbucks Corporation (NASDAQ:SBUX). This group of stocks’ market values match RIO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVDA | 41 | 1158110 | -15 |

| AXP | 50 | 17375313 | 0 |

| GILD | 57 | 2884640 | 1 |

| SBUX | 42 | 3366976 | 9 |

| Average | 47.5 | 6196260 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 47.5 hedge funds with bullish positions and the average amount invested in these stocks was $6196 million. That figure was $1143 million in RIO’s case. Gilead Sciences, Inc. (NASDAQ:GILD) is the most popular stock in this table. On the other hand NVIDIA Corporation (NASDAQ:NVDA) is the least popular one with only 41 bullish hedge fund positions. Compared to these stocks Rio Tinto Group (NYSE:RIO) is even less popular than NVDA, however the hedge fund sentiment started to improve in December as some hedge funds saw an opportunity to snap up cheap shares. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on RIO as the stock returned 24.4% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.