Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of BorgWarner Inc. (NYSE:BWA).

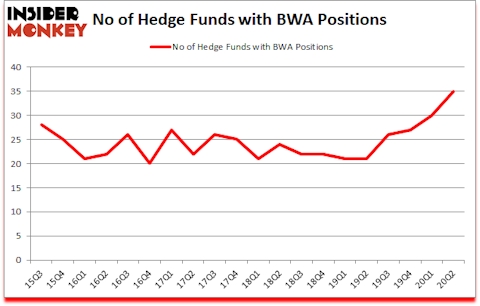

Is BorgWarner Inc. (NYSE:BWA) worth your attention right now? The smart money was taking a bullish view. The number of long hedge fund positions improved by 5 lately. BorgWarner Inc. (NYSE:BWA) was in 35 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 30. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that BWA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

John Rogers of Ariel Investments

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 biggest telecom companies to identify fast growing companies in various industries. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now we’re going to analyze the new hedge fund action surrounding BorgWarner Inc. (NYSE:BWA).

Hedge fund activity in BorgWarner Inc. (NYSE:BWA)

At Q2’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in BWA over the last 20 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Diamond Hill Capital, managed by Ric Dillon, holds the biggest position in BorgWarner Inc. (NYSE:BWA). Diamond Hill Capital has a $375.9 million position in the stock, comprising 2.2% of its 13F portfolio. Sitting at the No. 2 spot is Citadel Investment Group, led by Ken Griffin, holding a $81.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism consist of John W. Rogers’s Ariel Investments, Israel Englander’s Millennium Management and Matthew Mark’s Jet Capital Investors. In terms of the portfolio weights assigned to each position Halcyon Asset Management allocated the biggest weight to BorgWarner Inc. (NYSE:BWA), around 10.62% of its 13F portfolio. Jet Capital Investors is also relatively very bullish on the stock, earmarking 7.02 percent of its 13F equity portfolio to BWA.

As one would reasonably expect, key hedge funds have jumped into BorgWarner Inc. (NYSE:BWA) headfirst. Halcyon Asset Management, managed by John Bader, created the biggest position in BorgWarner Inc. (NYSE:BWA). Halcyon Asset Management had $29 million invested in the company at the end of the quarter. Javier Velazquez’s Albar Capital also made a $8.2 million investment in the stock during the quarter. The other funds with brand new BWA positions are Steve Pigott’s Fort Baker Capital Management, Stephen C. Freidheim’s Cyrus Capital Partners, and Curtis Schenker and Craig Effron’s Scoggin.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as BorgWarner Inc. (NYSE:BWA) but similarly valued. These stocks are Vail Resorts, Inc. (NYSE:MTN), Hill-Rom Holdings, Inc. (NYSE:HRC), Vornado Realty Trust (NYSE:VNO), Reynolds Consumer Products Inc. (NASDAQ:REYN), Exelixis, Inc. (NASDAQ:EXEL), Americold Realty Trust (NYSE:COLD), and Formula One Group (NASDAQ:FWONA). This group of stocks’ market values are similar to BWA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTN | 37 | 753210 | 0 |

| HRC | 30 | 944643 | 0 |

| VNO | 17 | 126380 | -8 |

| REYN | 17 | 319911 | 0 |

| EXEL | 39 | 1170545 | 9 |

| COLD | 29 | 290324 | 4 |

| FWONA | 17 | 248890 | 0 |

| Average | 26.6 | 550558 | 0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.6 hedge funds with bullish positions and the average amount invested in these stocks was $551 million. That figure was $803 million in BWA’s case. Exelixis, Inc. (NASDAQ:EXEL) is the most popular stock in this table. On the other hand Vornado Realty Trust (NYSE:VNO) is the least popular one with only 17 bullish hedge fund positions. BorgWarner Inc. (NYSE:BWA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BWA is 80.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and beat the market again by 20.1 percentage points. Unfortunately BWA wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on BWA were disappointed as the stock returned -0.5% since the end of June (through 10/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Borgwarner Inc (NYSE:BWA)

Follow Borgwarner Inc (NYSE:BWA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.