Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 835 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Becton, Dickinson and Company (NYSE:BDX) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

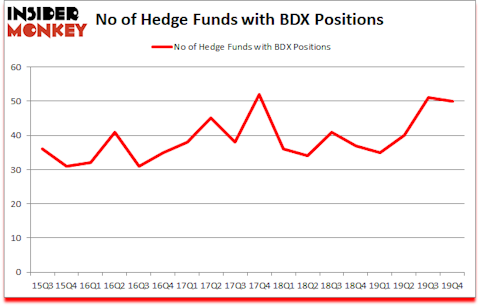

Becton, Dickinson and Company (NYSE:BDX) investors should pay attention to a decrease in hedge fund sentiment of late. BDX was in 50 hedge funds’ portfolios at the end of December. There were 51 hedge funds in our database with BDX holdings at the end of the previous quarter. Our calculations also showed that BDX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

With all of this in mind we’re going to review the recent hedge fund action encompassing Becton, Dickinson and Company (NYSE:BDX).

What does smart money think about Becton, Dickinson and Company (NYSE:BDX)?

At Q4’s end, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of -2% from the previous quarter. On the other hand, there were a total of 37 hedge funds with a bullish position in BDX a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Cantillon Capital Management was the largest shareholder of Becton, Dickinson and Company (NYSE:BDX), with a stake worth $327.9 million reported as of the end of September. Trailing Cantillon Capital Management was Millennium Management, which amassed a stake valued at $163.8 million. Generation Investment Management, Two Sigma Advisors, and Intermede Investment Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Endurant Capital Management allocated the biggest weight to Becton, Dickinson and Company (NYSE:BDX), around 4.89% of its 13F portfolio. Intermede Investment Partners is also relatively very bullish on the stock, designating 4.41 percent of its 13F equity portfolio to BDX.

Seeing as Becton, Dickinson and Company (NYSE:BDX) has experienced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedgies that slashed their positions entirely last quarter. Interestingly, Doug Silverman and Alexander Klabin’s Senator Investment Group sold off the biggest position of all the hedgies tracked by Insider Monkey, totaling close to $25.3 million in stock. Krishen Sud’s fund, Sivik Global Healthcare, also sold off its stock, about $5.1 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Becton, Dickinson and Company (NYSE:BDX). These stocks are The TJX Companies, Inc. (NYSE:TJX), Ambev SA (NYSE:ABEV), CME Group Inc (NASDAQ:CME), and Banco Bradesco SA (NYSE:BBD). This group of stocks’ market caps are closest to BDX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TJX | 57 | 2182820 | 4 |

| ABEV | 14 | 548416 | -5 |

| CME | 54 | 2402338 | 2 |

| BBD | 18 | 661816 | 1 |

| Average | 35.75 | 1448848 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.75 hedge funds with bullish positions and the average amount invested in these stocks was $1449 million. That figure was $1447 million in BDX’s case. The TJX Companies, Inc. (NYSE:TJX) is the most popular stock in this table. On the other hand Ambev SA (NYSE:ABEV) is the least popular one with only 14 bullish hedge fund positions. Becton, Dickinson and Company (NYSE:BDX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but still beat the market by 12.9 percentage points. Hedge funds were also right about betting on BDX, though not to the same extent, as the stock returned -7.1% during the first four months of 2020 (through May 1st) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.