Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards American Water Works Company, Inc. (NYSE:AWK) to find out whether there were any major changes in hedge funds’ views.

Hedge fund interest in American Water Works Company, Inc. (NYSE:AWK) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that AWK isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). At the end of this article we will also compare AWK to other stocks including Magna International Inc. (NYSE:MGA), Yum China Holdings, Inc. (NYSE:YUMC), and Lufax Holding Ltd (NYSE:LU) to get a better sense of its popularity.

Today there are several signals investors can use to value their holdings. A duo of the best signals are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the top investment managers can outclass the broader indices by a significant amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Dmitry Balyasny of Balyasny Asset Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s check out the recent hedge fund action regarding American Water Works Company, Inc. (NYSE:AWK).

Do Hedge Funds Think AWK Is A Good Stock To Buy Now?

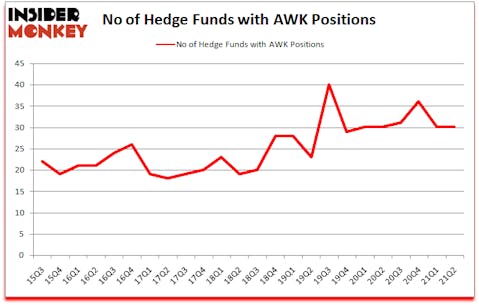

At the end of June, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the first quarter of 2020. By comparison, 30 hedge funds held shares or bullish call options in AWK a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ian Simm’s Impax Asset Management has the biggest position in American Water Works Company, Inc. (NYSE:AWK), worth close to $858.8 million, amounting to 3.8% of its total 13F portfolio. Coming in second is AQR Capital Management, led by Cliff Asness, holding a $54.9 million position; 0.1% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions encompass D. E. Shaw’s D E Shaw, Phill Gross and Robert Atchinson’s Adage Capital Management and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Trellus Management Company allocated the biggest weight to American Water Works Company, Inc. (NYSE:AWK), around 5.49% of its 13F portfolio. Impax Asset Management is also relatively very bullish on the stock, earmarking 3.79 percent of its 13F equity portfolio to AWK.

Because American Water Works Company, Inc. (NYSE:AWK) has experienced falling interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of hedge funds that elected to cut their full holdings heading into Q3. Intriguingly, Paul Marshall and Ian Wace’s Marshall Wace LLP sold off the largest position of the “upper crust” of funds tracked by Insider Monkey, totaling an estimated $27.7 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also dumped its stock, about $19 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to American Water Works Company, Inc. (NYSE:AWK). We will take a look at Magna International Inc. (NYSE:MGA), Yum China Holdings, Inc. (NYSE:YUMC), Lufax Holding Ltd (NYSE:LU), Garmin Ltd. (NASDAQ:GRMN), Franco-Nevada Corporation (NYSE:FNV), Delta Air Lines, Inc. (NYSE:DAL), and Arista Networks Inc (NYSE:ANET). This group of stocks’ market caps match AWK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGA | 39 | 576231 | 5 |

| YUMC | 32 | 913525 | -2 |

| LU | 19 | 357817 | 10 |

| GRMN | 25 | 477151 | 2 |

| FNV | 23 | 959211 | 3 |

| DAL | 49 | 1218077 | -1 |

| ANET | 35 | 318271 | 9 |

| Average | 31.7 | 688612 | 3.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.7 hedge funds with bullish positions and the average amount invested in these stocks was $689 million. That figure was $1077 million in AWK’s case. Delta Air Lines, Inc. (NYSE:DAL) is the most popular stock in this table. On the other hand Lufax Holding Ltd (NYSE:LU) is the least popular one with only 19 bullish hedge fund positions. American Water Works Company, Inc. (NYSE:AWK) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for AWK is 45.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 through November 5th and still beat the market by 3.1 percentage points. A small number of hedge funds were also right about betting on AWK as the stock returned 10.5% since the end of the second quarter (through 11/5) and outperformed the market by an even larger margin.

Follow American Water Works Company Inc. (NYSE:AWK)

Follow American Water Works Company Inc. (NYSE:AWK)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Countries With The Highest Standard of Living in 2020

- 20 Biggest One Hit Wonders of All Time

- 25 Worst Cities For Allergies

Disclosure: None. This article was originally published at Insider Monkey.