In this article we will check out the progression of hedge fund sentiment towards Agree Realty Corporation (NYSE:ADC) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

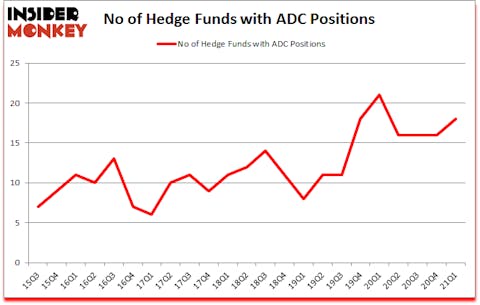

Agree Realty Corporation (NYSE:ADC) was in 18 hedge funds’ portfolios at the end of March. The all time high for this statistic is 21. ADC investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. There were 16 hedge funds in our database with ADC positions at the end of the fourth quarter. Our calculations also showed that ADC isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 115 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Clint Carlson of Carlson Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to view the new hedge fund action encompassing Agree Realty Corporation (NYSE:ADC).

Do Hedge Funds Think ADC Is A Good Stock To Buy Now?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ADC over the last 23 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Zimmer Partners was the largest shareholder of Agree Realty Corporation (NYSE:ADC), with a stake worth $101 million reported as of the end of March. Trailing Zimmer Partners was Millennium Management, which amassed a stake valued at $42.4 million. Two Sigma Advisors, Carlson Capital, and Hill Winds Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Hill Winds Capital allocated the biggest weight to Agree Realty Corporation (NYSE:ADC), around 3.96% of its 13F portfolio. Zimmer Partners is also relatively very bullish on the stock, setting aside 1.37 percent of its 13F equity portfolio to ADC.

Now, key money managers were leading the bulls’ herd. Citadel Investment Group, managed by Ken Griffin, established the most outsized call position in Agree Realty Corporation (NYSE:ADC). Citadel Investment Group had $1.6 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $1.5 million position during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management, Karim Abbadi and Edward McBride’s Centiva Capital, and Donald Sussman’s Paloma Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Agree Realty Corporation (NYSE:ADC) but similarly valued. These stocks are KB Home (NYSE:KBH), Ryman Hospitality Properties, Inc. (NYSE:RHP), Driven Brands Holdings Inc. (NASDAQ:DRVN), Portland General Electric Company (NYSE:POR), PS Business Parks Inc (NYSE:PSB), Chesapeake Energy Corporation (NYSE:CHK), and Teradata Corporation (NYSE:TDC). This group of stocks’ market values match ADC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KBH | 24 | 359374 | -4 |

| RHP | 22 | 356062 | 2 |

| DRVN | 18 | 137611 | 18 |

| POR | 21 | 68488 | 2 |

| PSB | 12 | 112420 | -3 |

| CHK | 42 | 1821541 | 42 |

| TDC | 26 | 480526 | 0 |

| Average | 23.6 | 476575 | 8.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.6 hedge funds with bullish positions and the average amount invested in these stocks was $477 million. That figure was $200 million in ADC’s case. Chesapeake Energy Corporation (NYSE:CHK) is the most popular stock in this table. On the other hand PS Business Parks Inc (NYSE:PSB) is the least popular one with only 12 bullish hedge fund positions. Agree Realty Corporation (NYSE:ADC) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ADC is 42.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.5% in 2021 through July 23rd and beat the market by 10.1 percentage points. A small number of hedge funds were also right about betting on ADC, though not to the same extent, as the stock returned 12.5% since the end of Q1 (through July 23rd) and outperformed the market.

Follow Agree Realty Corp (NYSE:ADC)

Follow Agree Realty Corp (NYSE:ADC)

Receive real-time insider trading and news alerts

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.