The latest 13F reporting period has come and gone, and Insider Monkey have plowed through 867 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th, when the S&P 500 Index was trading around the 4300 level. Since then investors decided to bet on the economic recovery and a stock market rebound even though we experienced a temporary correction in January. In this article you are going to find out whether hedge funds thought Sea Limited (NYSE:SE) was a good investment heading into the fourth quarter and how the stock traded in comparison to the top hedge fund picks.

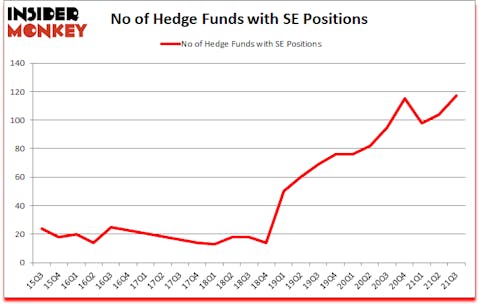

Is Sea Limited (NYSE:SE) a bargain? The best stock pickers were betting on the stock. The number of long hedge fund bets improved by 13 lately. Sea Limited (NYSE:SE) was in 117 hedge funds’ portfolios at the end of September. The all time high for this statistic was previously 115. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that SE ranked #12 among the 30 most popular stocks among hedge funds (click for Q3 rankings). There were 104 hedge funds in our database with SE positions at the end of the second quarter.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to take a look at the new hedge fund action regarding Sea Limited (NYSE:SE).

Do Hedge Funds Think SE Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 117 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SE over the last 25 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Tiger Global Management LLC, managed by Chase Coleman, holds the most valuable position in Sea Limited (NYSE:SE). Tiger Global Management LLC has a $3.3192 billion position in the stock, comprising 6.4% of its 13F portfolio. Sitting at the No. 2 spot is Kora Management, managed by Nitin Saigal and Dan Jacobs, which holds a $1.1105 billion position; the fund has 96.7% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions encompass Christopher Lyle’s SCGE Management, Philippe Laffont’s Coatue Management and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Kora Management allocated the biggest weight to Sea Limited (NYSE:SE), around 96.7% of its 13F portfolio. Panview Capital is also relatively very bullish on the stock, dishing out 33.63 percent of its 13F equity portfolio to SE.

As one would reasonably expect, specific money managers have jumped into Sea Limited (NYSE:SE) headfirst. D E Shaw, managed by D. E. Shaw, created the most valuable position in Sea Limited (NYSE:SE). D E Shaw had $205.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $191.7 million investment in the stock during the quarter. The other funds with brand new SE positions are Brandon Haley’s Holocene Advisors, Lei Zhang’s Hillhouse Capital Management, and James Dinan’s York Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Sea Limited (NYSE:SE). We will take a look at Shopify Inc (NYSE:SHOP), Medtronic plc (NYSE:MDT), T-Mobile US, Inc. (NASDAQ:TMUS), SAP SE (NYSE:SAP), United Parcel Service, Inc. (NYSE:UPS), Moderna, Inc. (NASDAQ:MRNA), and NextEra Energy, Inc. (NYSE:NEE). This group of stocks’ market valuations are closest to SE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHOP | 73 | 11451372 | -12 |

| MDT | 62 | 2278950 | -6 |

| TMUS | 89 | 6928776 | -11 |

| SAP | 15 | 1529829 | -2 |

| UPS | 42 | 1266269 | -10 |

| MRNA | 49 | 7315014 | 12 |

| NEE | 53 | 2374429 | -6 |

| Average | 54.7 | 4734948 | -5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 54.7 hedge funds with bullish positions and the average amount invested in these stocks was $4735 million. That figure was $14135 million in SE’s case. T-Mobile US, Inc. (NASDAQ:TMUS) is the most popular stock in this table. On the other hand SAP SE (NYSE:SAP) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Sea Limited (NYSE:SE) is more popular among hedge funds. Our overall hedge fund sentiment score for SE is 94.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Unfortunately, SE wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on SE were disappointed as the stock returned -52.8% since the end of the third quarter (through 1/31) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as all of these stocks already outperformed the market since 2019.

Follow Sea Ltd (NYSE:SE)

Follow Sea Ltd (NYSE:SE)

Receive real-time insider trading and news alerts

Suggested Articles:

- Warren Buffett’s Top 10 Stock Picks

- 13 Most Influential Women To Watch in 2021

- 10 Best High Dividend Stocks to Buy

Disclosure: None. This article was originally published at Insider Monkey.