Only once before in recorded history have mortgage rates been more volatile than they are right now. Want to guess when that was? Try November 2008, a mere two months after the fall of Lehman Brothers triggered the worst financial crisis since the Great Depression.

The following chart illustrates this point. It shows that the rate on a conventional 30-year fixed-rate mortgage has fluctuated an average of 6.38% in each of the past four weeks. And all together, rates have skyrocketed by nearly a third since the beginning of May.

What’s causing the angst?

The source of the volatility is common knowledge at this point — that is, the Federal Reserve. This past week, Fed Chairman Ben Bernanke testified once again to the effect that the central bank could begin moderating its support for the economy, which consists of monthly bond purchases, later this year if growth and employment pick up and inflation remains muted.

Now, to be clear, these are big “ifs.” As Bernanke noted, “because our asset purchases depend on economic and financial developments, they are by no means on a preset course.”

What’s more interesting, in turn, is the impact that the rising rates have had on the mortgage and therefore housing industries. As I’ve discussed before, common sense seems to dictate that a rapid increase in rates would result in a precipitous decline in demand for new mortgages. But we’ve since come to find out that this hypothesis is only partially true.

On the other hand, and here’s where it gets interesting, we’ve seen little perceptible impact on purchase-money mortgage originations. If anything, in fact, the exact opposite has occurred, as purchase-money volume at both Wells Fargo & Co (NYSE:WFC) and JPMorgan Chase & Co. (NYSE:JPM) picked up last quarter by 46% and 44%, respectively — by means of context, JPMorgan is the nation’s second largest mortgage originator.

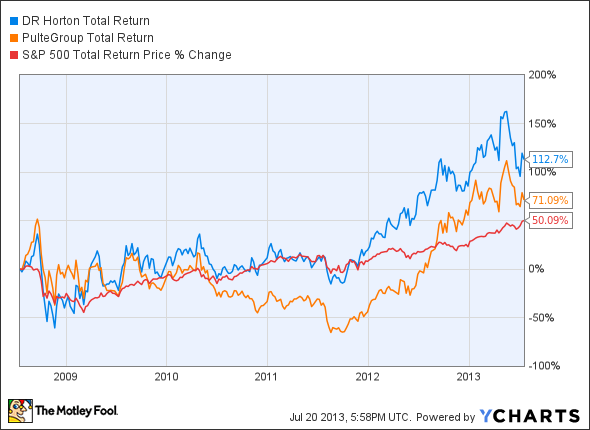

Suffice it to say, this has been a huge relief to homebuilders, who have only recently begun to fully recover from the crisis. D.R. Horton, Inc. (NYSE:DHI) and PulteGroup, Inc. (NYSE:PHM), for instance, the nation’s two largest homebuilders, recently reported year-over-year increases of 33% and 23%, respectively, in quarterly deliveries. It’s no surprise, in turn, that shares of both companies have outperformed the S&P 500 over the past five years.

DHI Total Return Price data by YCharts

Mortgage rates will head higher

The observation that higher mortgage rates aren’t putting an undue damper on the demand for purchase-money mortgages, and thus housing, is very good news. This is because mortgage rates are bound to go even higher. It’s inevitable.

If you ignore the distraction of surging rates for the moment, you can’t help acknowledging that mortgages are still dirt cheap. The average interest rate on a 30-year fixed-rate mortgage since 1971 is 8.61%. At the end of last week, it was 4.37%, or roughly half the long-run average.

At this point, it’s no longer a question if the Fed will reduce its support for the economy, but rather when it will do so. And when it does, given the mechanics of the bond market and the precise nature of the central bank’s support over the past few months, mortgage rates will continue their ascent.

For you, the average Joe or Jane, the net result is simple: If you’ve been on the fence about buying a home, it’s probably as good of a time as any to make up your mind.

The article News Flash: Mortgage Rates Will Head Higher originally appeared on Fool.com and is written by John Maxfield.

John Maxfield has no position in any stocks mentioned. The Motley Fool recommends Wells Fargo and owns shares of JPMorgan Chase and (NYSE:JPM) Wells Fargo.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.