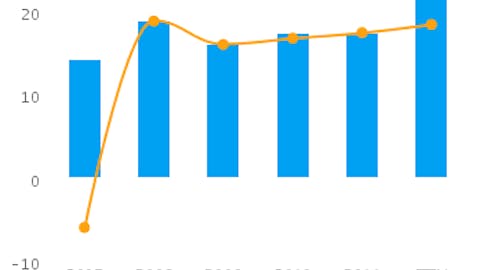

Bank of America Corp (NYSE:BAC) is up 70% so far this year. True, the stock is still down tremendously from pre-crisis levels- it is 80% below its price five years ago- but the banking industry as a whole seems to be picking up as housing in particular improves. Bank of America’s most recent quarterly report was a bit disappointing for us, as the bank was barely profitable, though this was partly due to litigation charges. Costs actually rose despite the company’s ongoing initiative to reduce expenses, as layoffs have been partially offset by adding contractors and ongoing mortgage issues. The bank was expected to show slight losses in its report for the third quarter- 7 cents per share according to analyst expectations- but we’re not particularly happy with Bank of America’s progress.

Bank of America Corp, with a market capitalization which has climbed to just above $100 billion, is now trading at about half the book value of its equity. With book value being a good way to look at a bank’s valuation, it seems on its face like a value play despite its recent poor performance- eventually its market value should rise to reflect the fundamental of its balance sheet, assuming that the assets are valued correctly on that balance sheet. It does trade at 10 times forward earnings estimates, which at least suggests that the bank is having difficulty getting a good return on those assets, and pays a dividend yield of only 0.4% (quite low for a major bank). We’ve liked Bank of America in the past, but with it up 27% in the last three months perhaps it is time for the stock price to take a pause.

When 13F filings for the end of September are released, we’ll look carefully at how hedge funds and other notable investors are playing Bank of America Corp. In the second quarter, it made our list of the most popular stocks among hedge funds. Out of the investors tracked in our database of 13F filings, Bruce Berkowitz’s Fairholme was the largest owner of Bank of America at the end of June with a position of just over 100 million shares (find more of Bruce Berkowitz’s favorite stocks). Platinum Asset Management increased its stake in Bank of America by 17% during the quarter, closing June with 35 million shares in its portfolio. Platinum, which has about $18 billion in Australian dollars under management, is managed by Kerr Nielson. See more stock picks from Platinum Asset Management.

Bank of America is best compared to Citigroup Inc. (NYSE:C) and JPMorgan Chase & Co. (NYSE:JPM). Both of these megabanks also trade at discounts to their book value, though JPMorgan Chase’s is fairly small at a P/B of 0.9 (Citi’s P/B is 0.6). Citi is about the same size as Bank of America in terms of market capitalization, while JPMorgan Chase has a market cap of about $170 billion. Therefore, all three have a book value in the range of $200 billion and differences in their valuation in the market are mostly due to the degree of investor confidence in their assets. It should also be noted that, at 8 times consensus earnings for 2013, both Citi and JPMorgan Chase trade at a discount to Bank of America on that basis; we also like JPMorgan Chase’s 2.8% dividend yield.

Wells Fargo & Company (NYSE:WFC) and PNC Financial Services (NYSE:PNC) are also peers for Bank of America. Wells is generally considered the safest, most reliable of the major banks for investors, and as a result it trades at a premium to the book value of its equity at a P/B of 1.3. On an earnings basis it is actually even with Bank of America at a forward P/E of 10, and with a good dividend yield itself of 2.6% it is possible that Bank of America’s stock has risen to the point where it is not as good a buy as Wells Fargo (which is up only 2% in the last three months). PNC, a smaller (market cap of $32 billion) but growing bank, is another place where investors are skeptical. It trades at a P/B of 0.8 and at 9 times forward earnings estimates, with a dividend yield roughly even with that of JPMorgan Chase and Wells Fargo. It could be a good stock to follow if its earnings growth continues.

Investors who have been in Bank of America for the past year have made good profits, and we think it’s time to take them. Other banks have higher P/B multiples, but Bank of America seems to have far more problems than still-cheap peers like Citigroup and JPMorgan Chase.