G2 Investment Partners Management is a New York-based hedge fund run by Josh Goldberg. The fund’s equity portfolio went up to $217.97 million from $216.67 million during the third quarter. The fund invests mainly in tech stocks, which paid off handsomely last quarter, as, according to our calculations, its long positions in companies valued at over $1.0 billion returned 17.44% in the third quarter, based on the value of the positions at the end of June.

G2 Investment Partners Management’s positive returns in the third quarter confirm a very interesting trend that we have seen consistently in almost 95% of the 660 hedge funds we track. Hedge funds having long positions in companies with a market-cap over of at least $1 billion post positive returns. Hedge funds on average underperform in bull markets because they are hedged, and their returns contract due to losses from the short sides of portfolios. But Insider Monkey focuses only on long non-microcap positions to efficiently bet on the stocks. In the third quarter, hedge funds in our database with long positions in non-microcap companies managed to deliver an average return of 8.3%, versus the S&P 500 ETFs returned only 3.3%.

solarseven/Shutterstock.com

With this in mind, let’s take a closer look at four of G2 Investment’s bets last quarter.

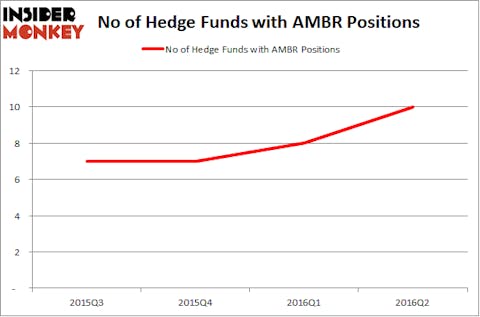

G2 Investment Partners Management upped its stake in Amber Road Inc (NYSE:AMBR) by 30% in the second quarter and by another 3% in the third quarter, holding 1.44 million shares worth $13.87 million at the end of September, amid a 25.2% return generated by the stock in the third quarter. At the end of the second quarter, 10 funds tracked by Insider Monkey were bullish on this stock, up by 25% from the previous quarter. Among these funds, Discovery Group held the most valuable stake in Amber Road Inc (NYSE:AMBR), which was worth $19.9 millions at the end of the second quarter. Moreover, Royce & Associates, Renaissance Technologies, and Coe Capital Management were also bullish on Amber Road Inc (NYSE:AMBR).

Follow Amber Road Inc. (NASDAQ:AMBR)

Follow Amber Road Inc. (NASDAQ:AMBR)

Receive real-time insider trading and news alerts

After having increased its stake by 20% in the second quarter, G2 Investment Partners Management cut the position in Ellie Mae Inc (NYSE:ELLI) by 52% in the following three months amid a 14.9% gain registered by the stock. At the end of September, the fund held 41,772 shares of Ellie Mae worth $4.40 million. Ellie Mae Inc (NYSE:ELLI) was included in the equity portfolios of 24 funds tracked by our team at the end of June, down from 28 funds a quarter earlier. More specifically, Alex Sacerdote’s Whale Rock Capital Management had the most valuable position in Ellie Mae Inc (NYSE:ELLI), worth close to $102.7 million. On Whale Rock Capital Management’s heels was Park West Asset Management, led by Peter S. Park, holding a $42.1 million position. Other peers with similar optimism included Brett Barakett’s Tremblant Capital, Edmond M. Safra’s EMS Capital and Eduardo Costa’s Calixto Global Investors.

Follow Ellie Mae Inc (OTCMKTS:ELLI)

Follow Ellie Mae Inc (OTCMKTS:ELLI)

Receive real-time insider trading and news alerts

Euronet Worldwide, Inc. (NASDAQ:EEFT) is another company on which G2 Investment Partners Management was bullish in the last two quarters and after increasing the stake by 51% in the second quarter and by 14% in the third, it held 127,025 shares worth $10.39 million at the end of September. Meanwhile, the stock gained 18.3% in the third quarter. Heading into the third quarter of 2016, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, up by 65% sequentially. Among these funds, Renaissance Technologies held the most valuable stake in Euronet Worldwide, Inc. (NASDAQ:EEFT), which was worth $59.5 million at the end of the second quarter. On the second spot was Adage Capital Management which amassed $23.9 million worth of shares. Moreover, Portolan Capital Management, Millennium Management, and Clinton Group were also bullish on Euronet Worldwide, Inc. (NASDAQ:EEFT).

Follow Euronet Worldwide Inc. (NASDAQ:EEFT)

Follow Euronet Worldwide Inc. (NASDAQ:EEFT)

Receive real-time insider trading and news alerts

Last, but not least, G2 Investment cut its stake in Gigamon Inc (NYSE:GIMO) by 59% in the third quarter and reported ownership of 72,772 shares worth $3.99 million in its last 13F filing. The stock returned 46.6% during the third quarter. During the second quarter, the number of funds tracked by Insider Monkey inched down by one to 22. The largest stake in Gigamon Inc (NYSE:GIMO) was held by Renaissance Technologies, which reported holding $47.1 million worth of stock as of the end of June. It was followed by Millennium Management with a $25.8 million position. Other investors bullish on the company included Alyeska Investment Group, Harvest Capital Strategies, and Lyon Street Capital.

Follow Gigamon Inc. (NYSE:GIMO)

Follow Gigamon Inc. (NYSE:GIMO)

Receive real-time insider trading and news alerts

Disclosure: none