While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, virus news and stimulus talks, many smart money investors are starting to get cautious towards the current bull run since March and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 30,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Grand Canyon Education Inc (NASDAQ:LOPE).

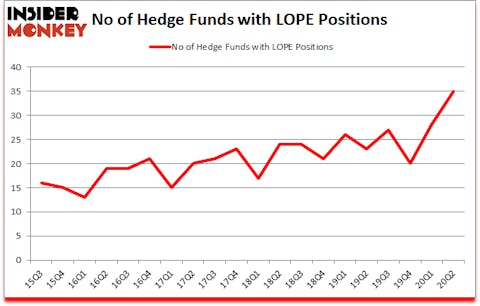

Is Grand Canyon Education Inc (NASDAQ:LOPE) a buy here? The best stock pickers were getting more bullish. The number of long hedge fund bets increased by 7 lately. Grand Canyon Education Inc (NASDAQ:LOPE) was in 35 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 28. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that LOPE isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are viewed as worthless, outdated investment tools of the past. While there are greater than 8000 funds with their doors open at present, Our experts hone in on the crème de la crème of this club, about 850 funds. It is estimated that this group of investors shepherd the majority of the hedge fund industry’s total capital, and by monitoring their top picks, Insider Monkey has determined a few investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind we’re going to take a look at the recent hedge fund action surrounding Grand Canyon Education Inc (NASDAQ:LOPE).

How are hedge funds trading Grand Canyon Education Inc (NASDAQ:LOPE)?

Heading into the third quarter of 2020, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. By comparison, 23 hedge funds held shares or bullish call options in LOPE a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in Grand Canyon Education Inc (NASDAQ:LOPE) was held by Sachem Head Capital, which reported holding $63.4 million worth of stock at the end of June. It was followed by Park West Asset Management with a $22.4 million position. Other investors bullish on the company included Renaissance Technologies, Intrinsic Edge Capital, and Arrowstreet Capital. In terms of the portfolio weights assigned to each position Sachem Head Capital allocated the biggest weight to Grand Canyon Education Inc (NASDAQ:LOPE), around 4.51% of its 13F portfolio. Lyon Street Capital is also relatively very bullish on the stock, dishing out 3.01 percent of its 13F equity portfolio to LOPE.

As aggregate interest increased, some big names have been driving this bullishness. Sachem Head Capital, managed by Scott Ferguson, created the biggest position in Grand Canyon Education Inc (NASDAQ:LOPE). Sachem Head Capital had $63.4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $16.2 million position during the quarter. The other funds with new positions in the stock are Blair Baker’s Precept Capital Management, Qing Li’s Sciencast Management, and Donald Sussman’s Paloma Partners.

Let’s also examine hedge fund activity in other stocks similar to Grand Canyon Education Inc (NASDAQ:LOPE). We will take a look at Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN), Tetra Tech, Inc. (NASDAQ:TTEK), Lancaster Colony Corporation (NASDAQ:LANC), Inovio Pharmaceuticals Inc (NYSE:INO), FTI Consulting, Inc. (NYSE:FCN), Tata Motors Limited (NYSE:TTM), and Blueprint Medicines Corporation (NASDAQ:BPMC). This group of stocks’ market caps are closest to LOPE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BHVN | 42 | 915722 | 13 |

| TTEK | 19 | 90700 | -2 |

| LANC | 19 | 246200 | -4 |

| INO | 14 | 117679 | 6 |

| FCN | 32 | 377924 | 13 |

| TTM | 9 | 36380 | -1 |

| BPMC | 38 | 1004517 | 2 |

| Average | 24.7 | 398446 | 3.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.7 hedge funds with bullish positions and the average amount invested in these stocks was $398 million. That figure was $207 million in LOPE’s case. Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) is the most popular stock in this table. On the other hand Tata Motors Limited (NYSE:TTM) is the least popular one with only 9 bullish hedge fund positions. Grand Canyon Education Inc (NASDAQ:LOPE) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for LOPE is 79.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and beat the market again by 20.1 percentage points. Unfortunately LOPE wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on LOPE were disappointed as the stock returned -13.4% since the end of June (through 10/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Grand Canyon Education Inc. (NASDAQ:LOPE)

Follow Grand Canyon Education Inc. (NASDAQ:LOPE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.