Is Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

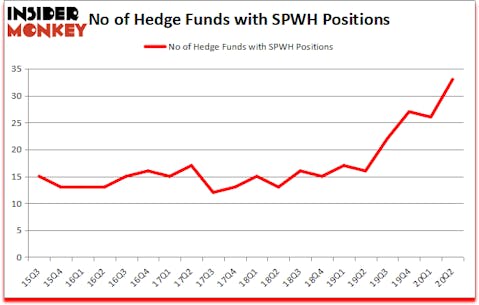

Is Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) the right pick for your portfolio? Prominent investors were in a bullish mood. The number of bullish hedge fund positions increased by 7 in recent months. Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) was in 33 hedge funds’ portfolios at the end of June. The all time high for this statistics is 27. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that SPWH isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are plenty of formulas investors employ to grade publicly traded companies. A couple of the most innovative formulas are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best hedge fund managers can beat their index-focused peers by a very impressive margin (see the details here).

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now we’re going to take a peek at the recent hedge fund action regarding Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH).

Hedge fund activity in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH)

At second quarter’s end, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in SPWH a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Greenhouse Funds, managed by Joe Milano, holds the most valuable position in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH). Greenhouse Funds has a $27.4 million position in the stock, comprising 4.1% of its 13F portfolio. The second most bullish fund manager is Cannell Capital, managed by J. Carlo Cannell, which holds a $23.6 million position; 8.9% of its 13F portfolio is allocated to the company. Other peers that hold long positions consist of George McCabe’s Portolan Capital Management, Angela Aldrich’s Bayberry Capital Partners and Richard Driehaus’s Driehaus Capital. In terms of the portfolio weights assigned to each position Cannell Capital allocated the biggest weight to Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH), around 8.85% of its 13F portfolio. Greenhouse Funds is also relatively very bullish on the stock, earmarking 4.09 percent of its 13F equity portfolio to SPWH.

As one would reasonably expect, key money managers were breaking ground themselves. Bayberry Capital Partners, managed by Angela Aldrich, assembled the most outsized position in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH). Bayberry Capital Partners had $15.9 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $3.4 million position during the quarter. The following funds were also among the new SPWH investors: Renaissance Technologies, Israel Englander’s Millennium Management, and Mark Broach’s Manatuck Hill Partners.

Let’s also examine hedge fund activity in other stocks similar to Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH). We will take a look at Liberty Oilfield Services Inc. (NYSE:LBRT), Tutor Perini Corp (NYSE:TPC), Knoll Inc (NYSE:KNL), Invesco Mortgage Capital Inc (NYSE:IVR), Ardelyx Inc (NASDAQ:ARDX), Orthofix Medical Inc (NASDAQ:OFIX), and Tenneco Inc (NYSE:TEN). This group of stocks’ market caps resemble SPWH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBRT | 6 | 7305 | -6 |

| TPC | 16 | 23834 | 6 |

| KNL | 7 | 10777 | -4 |

| IVR | 12 | 15886 | -3 |

| ARDX | 24 | 242673 | 4 |

| OFIX | 19 | 100623 | 2 |

| TEN | 14 | 87799 | -3 |

| Average | 14 | 69842 | -0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $152 million in SPWH’s case. Ardelyx Inc (NASDAQ:ARDX) is the most popular stock in this table. On the other hand Liberty Oilfield Services Inc. (NYSE:LBRT) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) is more popular among hedge funds. Our overall hedge fund sentiment score for SPWH is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Unfortunately SPWH wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on SPWH were disappointed as the stock returned -8.6% since the end of the second quarter (through 10/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Sportsman's Warehouse Holdings Inc. (NASDAQ:SPWH)

Follow Sportsman's Warehouse Holdings Inc. (NASDAQ:SPWH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.