Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Spirit AeroSystems Holdings, Inc. (NYSE:SPR).

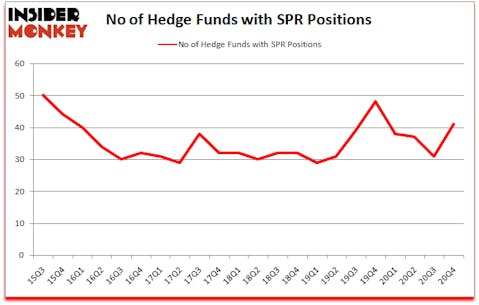

Spirit AeroSystems Holdings, Inc. (NYSE:SPR) was in 41 hedge funds’ portfolios at the end of December. The all time high for this statistic is 50. SPR has seen an increase in hedge fund sentiment lately. There were 31 hedge funds in our database with SPR positions at the end of the third quarter. Our calculations also showed that SPR isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 197% since March 2017 and outperformed the S&P 500 ETFs by more than 124 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Jeremy Mindich of Scopia Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s review the recent hedge fund action encompassing Spirit AeroSystems Holdings, Inc. (NYSE:SPR).

Do Hedge Funds Think SPR Is A Good Stock To Buy Now?

At Q4’s end, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a change of 32% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SPR over the last 22 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Matt Sirovich and Jeremy Mindich’s Scopia Capital has the number one position in Spirit AeroSystems Holdings, Inc. (NYSE:SPR), worth close to $223.9 million, amounting to 28.3% of its total 13F portfolio. Sitting at the No. 2 spot is OZ Management, managed by Daniel S. Och, which holds a $203.4 million position; the fund has 0.9% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions comprise Ken Griffin’s Citadel Investment Group, John Overdeck and David Siegel’s Two Sigma Advisors and Ryan Pedlow’s Two Creeks Capital Management. In terms of the portfolio weights assigned to each position Scopia Capital allocated the biggest weight to Spirit AeroSystems Holdings, Inc. (NYSE:SPR), around 28.33% of its 13F portfolio. Crestwood Capital Management is also relatively very bullish on the stock, designating 4.42 percent of its 13F equity portfolio to SPR.

Now, specific money managers have jumped into Spirit AeroSystems Holdings, Inc. (NYSE:SPR) headfirst. Fir Tree, managed by Jeffrey Tannenbaum, initiated the most valuable position in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). Fir Tree had $43 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $25.1 million position during the quarter. The following funds were also among the new SPR investors: Joseph Samuels’s Islet Management, Robert Pohly’s Samlyn Capital, and Renaissance Technologies.

Let’s also examine hedge fund activity in other stocks similar to Spirit AeroSystems Holdings, Inc. (NYSE:SPR). We will take a look at Vivint Smart Home, Inc. (NYSE:VVNT), Highwoods Properties Inc (NYSE:HIW), Cosan Limited (NYSE:CZZ), Hamilton Lane Incorporated (NASDAQ:HLNE), Carter’s, Inc. (NYSE:CRI), Proto Labs Inc (NYSE:PRLB), and Silgan Holdings Inc. (NASDAQ:SLGN). This group of stocks’ market values are closest to SPR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VVNT | 9 | 12200 | 4 |

| HIW | 21 | 181618 | -4 |

| CZZ | 8 | 134889 | -6 |

| HLNE | 14 | 57341 | -2 |

| CRI | 25 | 316897 | -1 |

| PRLB | 16 | 654308 | 0 |

| SLGN | 16 | 207764 | 1 |

| Average | 15.6 | 223574 | -1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.6 hedge funds with bullish positions and the average amount invested in these stocks was $224 million. That figure was $996 million in SPR’s case. Carter’s, Inc. (NYSE:CRI) is the most popular stock in this table. On the other hand Cosan Limited (NYSE:CZZ) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Spirit AeroSystems Holdings, Inc. (NYSE:SPR) is more popular among hedge funds. Our overall hedge fund sentiment score for SPR is 84.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks returned 13.6% in 2021 through April 30th but still managed to beat the market by 1.6 percentage points. Hedge funds were also right about betting on SPR as the stock returned 16.9% since the end of December (through 4/30) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Spirit Aerosystems Holdings Inc. (NYSE:SPR)

Follow Spirit Aerosystems Holdings Inc. (NYSE:SPR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.