The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards New Oriental Education & Technology Group Inc. (NYSE:EDU).

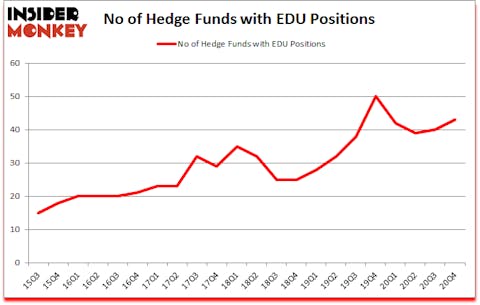

Is New Oriental Education & Technology Group Inc. (NYSE:EDU) undervalued? Investors who are in the know were in a bullish mood. The number of long hedge fund bets moved up by 3 in recent months. New Oriental Education & Technology Group Inc. (NYSE:EDU) was in 43 hedge funds’ portfolios at the end of December. The all time high for this statistic is 50. Our calculations also showed that EDU isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings). There were 40 hedge funds in our database with EDU holdings at the end of September.

In the eyes of most traders, hedge funds are seen as underperforming, old financial tools of the past. While there are greater than 8000 funds with their doors open today, Our experts choose to focus on the bigwigs of this club, about 850 funds. Most estimates calculate that this group of people oversee the lion’s share of all hedge funds’ total capital, and by tracking their finest picks, Insider Monkey has spotted numerous investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s review the new hedge fund action surrounding New Oriental Education & Technology Group Inc. (NYSE:EDU).

Do Hedge Funds Think EDU Is A Good Stock To Buy Now?

At the end of the fourth quarter, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from one quarter earlier. On the other hand, there were a total of 50 hedge funds with a bullish position in EDU a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

More specifically, Alkeon Capital Management was the largest shareholder of New Oriental Education & Technology Group Inc. (NYSE:EDU), with a stake worth $353.2 million reported as of the end of December. Trailing Alkeon Capital Management was Tiger Global Management LLC, which amassed a stake valued at $342.5 million. GQG Partners, Renaissance Technologies, and Farallon Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position IvyRock Asset Management allocated the biggest weight to New Oriental Education & Technology Group Inc. (NYSE:EDU), around 29.29% of its 13F portfolio. Serenity Capital is also relatively very bullish on the stock, setting aside 28.67 percent of its 13F equity portfolio to EDU.

Now, specific money managers were breaking ground themselves. D1 Capital Partners, managed by Daniel Sundheim, assembled the most outsized position in New Oriental Education & Technology Group Inc. (NYSE:EDU). D1 Capital Partners had $74.3 million invested in the company at the end of the quarter. Charles Huang’s IvyRock Asset Management also made a $47.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Richard Driehaus’s Driehaus Capital, Kevin Mok’s Hidden Lake Asset Management, and Run Ye, Junji Takegami and Hoyon Hwang’s Tiger Pacific Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as New Oriental Education & Technology Group Inc. (NYSE:EDU) but similarly valued. We will take a look at Seagen Inc. (NASDAQ:SGEN), SBA Communications Corporation (NASDAQ:SBAC), Royalty Pharma Plc (NASDAQ:RPRX), ANSYS, Inc. (NASDAQ:ANSS), AFLAC Incorporated (NYSE:AFL), Credit Suisse Group AG (NYSE:CS), and Kinder Morgan Inc (NYSE:KMI). This group of stocks’ market caps match EDU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SGEN | 32 | 8619222 | 4 |

| SBAC | 43 | 1761954 | 0 |

| RPRX | 18 | 3384693 | -2 |

| ANSS | 40 | 1633274 | 0 |

| AFL | 35 | 389034 | 1 |

| CS | 11 | 46020 | -2 |

| KMI | 42 | 1031459 | -4 |

| Average | 31.6 | 2409379 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.6 hedge funds with bullish positions and the average amount invested in these stocks was $2409 million. That figure was $2541 million in EDU’s case. SBA Communications Corporation (NASDAQ:SBAC) is the most popular stock in this table. On the other hand Credit Suisse Group AG (NYSE:CS) is the least popular one with only 11 bullish hedge fund positions. New Oriental Education & Technology Group Inc. (NYSE:EDU) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for EDU is 83.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and beat the market again by 1.6 percentage points. Unfortunately EDU wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on EDU were disappointed as the stock returned -17.9% since the end of December (through 4/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow New Oriental Education & Technology Group Inc. (NYSE:EDU)

Follow New Oriental Education & Technology Group Inc. (NYSE:EDU)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.