A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 30th, so let’s proceed with the discussion of the hedge fund sentiment on Mastercard Incorporated (NYSE:MA).

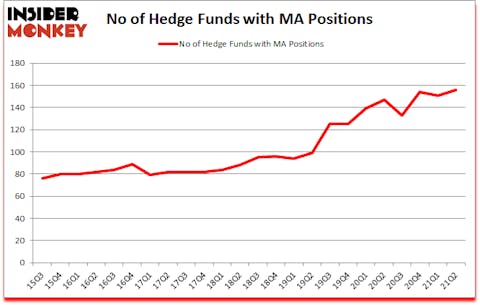

Is Mastercard Incorporated (NYSE:MA) worth your attention right now? The best stock pickers were getting more optimistic. The number of long hedge fund positions inched up by 5 lately. Mastercard Incorporated (NYSE:MA) was in 156 hedge funds’ portfolios at the end of June. The all time high for this statistic is 154. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that MA ranked 6th among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 151 hedge funds in our database with MA positions at the end of the first quarter.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

Now let’s go over the latest hedge fund action surrounding Mastercard Incorporated (NYSE:MA).

Do Hedge Funds Think MA Is A Good Stock To Buy Now?

At second quarter’s end, a total of 156 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MA over the last 24 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Akre Capital Management held the most valuable stake in Mastercard Incorporated (NYSE:MA), which was worth $2141.8 million at the end of the second quarter. On the second spot was Berkshire Hathaway which amassed $1666.5 million worth of shares. Fisher Asset Management, Gardner Russo & Gardner, and Lone Pine Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Valley Forge Capital allocated the biggest weight to Mastercard Incorporated (NYSE:MA), around 19.19% of its 13F portfolio. KG Funds Management is also relatively very bullish on the stock, setting aside 14.97 percent of its 13F equity portfolio to MA.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. Prana Capital Management, managed by Peter Seuss, assembled the largest position in Mastercard Incorporated (NYSE:MA). Prana Capital Management had $88.4 million invested in the company at the end of the quarter. Robert Boucai’s Newbrook Capital Advisors also made a $88.3 million investment in the stock during the quarter. The following funds were also among the new MA investors: Jack Woodruff’s Candlestick Capital Management, Jeffrey Talpins’s Element Capital Management, and Bijan Modanlou, Joseph Bou-Saba, and Jayaveera Kodali’s Alta Park Capital.

Let’s now review hedge fund activity in other stocks similar to Mastercard Incorporated (NYSE:MA). These stocks are Bank of America Corporation (NYSE:BAC), Paypal Holdings Inc (NASDAQ:PYPL), The Home Depot, Inc. (NYSE:HD), The Procter & Gamble Company (NYSE:PG), The Walt Disney Company (NYSE:DIS), ASML Holding N.V. (NASDAQ:ASML), and Adobe Inc. (NASDAQ:ADBE). This group of stocks’ market valuations resemble MA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAC | 87 | 46536945 | -10 |

| PYPL | 143 | 16352523 | 0 |

| HD | 64 | 4177204 | -4 |

| PG | 68 | 6934291 | -2 |

| DIS | 112 | 10830152 | -22 |

| ASML | 44 | 4323106 | 9 |

| ADBE | 89 | 13101408 | -18 |

| Average | 86.7 | 14607947 | -6.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 86.7 hedge funds with bullish positions and the average amount invested in these stocks was $14608 million. That figure was $17099 million in MA’s case. Paypal Holdings Inc (NASDAQ:PYPL) is the most popular stock in this table. On the other hand ASML Holding N.V. (NASDAQ:ASML) is the least popular one with only 44 bullish hedge fund positions. Compared to these stocks Mastercard Incorporated (NYSE:MA) is more popular among hedge funds. Our overall hedge fund sentiment score for MA is 97.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 26.3% in 2021 through October 29th and still beat the market by 2.3 percentage points. Unfortunately MA wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on MA were disappointed as the stock returned -7.9% since the end of the second quarter (through 10/29) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Mastercard Inc (NYSE:MA)

Follow Mastercard Inc (NYSE:MA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Most Expensive Things You Can Buy on Amazon Right Now

- 25 Most Obese Countries In the World

- 15 Most Expensive Islands to Visit in 2021

Disclosure: None. This article was originally published at Insider Monkey.