Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 823 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about TG Therapeutics Inc (NASDAQ:TGTX) in this article.

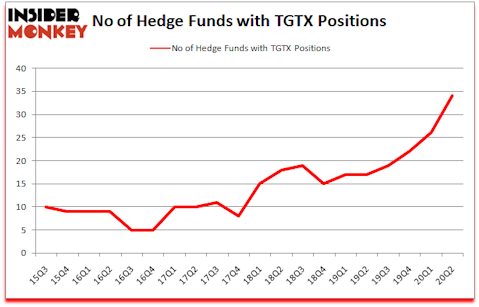

TG Therapeutics Inc (NASDAQ:TGTX) was in 34 hedge funds’ portfolios at the end of June. The all time high for this statistics is 26. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. TGTX investors should pay attention to an increase in activity from the world’s largest hedge funds lately. There were 26 hedge funds in our database with TGTX positions at the end of the first quarter. Our calculations also showed that TGTX isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are dozens of indicators stock traders use to value stocks. A couple of the less utilized indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the top hedge fund managers can outpace the S&P 500 by a significant margin (see the details here).

Kamran Moghtaderi of Eversept Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best high dividend stocks to buy to identify high dividend stocks with upside potential in this low interest rate environment. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to take a gander at the new hedge fund action surrounding TG Therapeutics Inc (NASDAQ:TGTX).

What does smart money think about TG Therapeutics Inc (NASDAQ:TGTX)?

At the end of the second quarter, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 31% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in TGTX over the last 20 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, RA Capital Management held the most valuable stake in TG Therapeutics Inc (NASDAQ:TGTX), which was worth $249.1 million at the end of the third quarter. On the second spot was Great Point Partners which amassed $64.7 million worth of shares. Eversept Partners, Alkeon Capital Management, and Farallon Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Eversept Partners allocated the biggest weight to TG Therapeutics Inc (NASDAQ:TGTX), around 7.87% of its 13F portfolio. Great Point Partners is also relatively very bullish on the stock, earmarking 5.17 percent of its 13F equity portfolio to TGTX.

Now, key money managers were breaking ground themselves. Farallon Capital, assembled the largest position in TG Therapeutics Inc (NASDAQ:TGTX). Farallon Capital had $29.2 million invested in the company at the end of the quarter. Didric Cederholm’s Lion Point also initiated a $17.5 million position during the quarter. The other funds with new positions in the stock are Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Noam Gottesman’s GLG Partners, and Michael Rockefeller and KarláKroeker’s Woodline Partners.

Let’s also examine hedge fund activity in other stocks similar to TG Therapeutics Inc (NASDAQ:TGTX). These stocks are Sabre Corporation (NASDAQ:SABR), NCR Corporation (NYSE:NCR), Independent Bank Corp (NASDAQ:INDB), Viela Bio, Inc. (NASDAQ:VIE), Pacira Biosciences Inc (NASDAQ:PCRX), Vishay Intertechnology, Inc. (NYSE:VSH), and Sensient Technologies Corporation (NYSE:SXT). This group of stocks’ market caps are similar to TGTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SABR | 39 | 412328 | 9 |

| NCR | 32 | 195774 | 0 |

| INDB | 7 | 10886 | 3 |

| VIE | 8 | 241277 | 2 |

| PCRX | 29 | 553399 | 3 |

| VSH | 28 | 333650 | 5 |

| SXT | 23 | 170066 | 0 |

| Average | 23.7 | 273911 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.7 hedge funds with bullish positions and the average amount invested in these stocks was $274 million. That figure was $632 million in TGTX’s case. Sabre Corporation (NASDAQ:SABR) is the most popular stock in this table. On the other hand Independent Bank Corp (NASDAQ:INDB) is the least popular one with only 7 bullish hedge fund positions. TG Therapeutics Inc (NASDAQ:TGTX) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for TGTX is 82.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on TGTX as the stock returned 29.7% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Tg Therapeutics Inc. (NASDAQ:TGTX)

Follow Tg Therapeutics Inc. (NASDAQ:TGTX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.