Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Haemonetics Corporation (NYSE:HAE)? The smart money sentiment can provide an answer to this question.

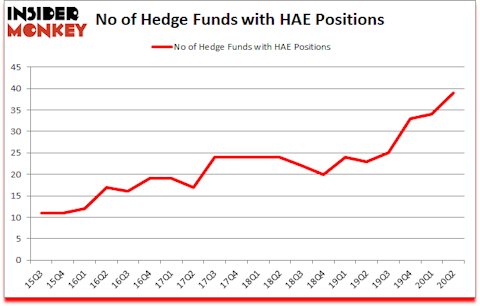

Is Haemonetics Corporation (NYSE:HAE) a healthy stock for your portfolio? Money managers were in an optimistic mood. The number of bullish hedge fund bets inched up by 5 lately. Haemonetics Corporation (NYSE:HAE) was in 39 hedge funds’ portfolios at the end of June. The all time high for this statistics is 34. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that HAE isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 34 hedge funds in our database with HAE positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Michael Gelband of ExodusPoint Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Our analysis determined that presidential election polls were wrong heading into the 2020 election and we were able to make the most accurate predictions in the country after making adjustments for the biases in existing polls. For example we predicted comfortable Trump victories in Florida, North Carolina, Texas, Iowa, and Ohio. We also predicted a very narrow Biden victory of 0.4 points in Wisconsin when most pollsters were predicting 8 to 10 points Biden victories. We are waiting for the results of 5 more states, but our accuracy rate so far is 100% (see our predictions). You can subscribe to our free daily newsletter on our website to get email alerts whenever we publish an interesting article. Now let’s analyze the recent hedge fund action encompassing Haemonetics Corporation (NYSE:HAE).

How have hedgies been trading Haemonetics Corporation (NYSE:HAE)?

At second quarter’s end, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards HAE over the last 20 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Haemonetics Corporation (NYSE:HAE), with a stake worth $195.9 million reported as of the end of June. Trailing Renaissance Technologies was Point72 Asset Management, which amassed a stake valued at $73.2 million. Royce & Associates, Nitorum Capital, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position BeaconLight Capital allocated the biggest weight to Haemonetics Corporation (NYSE:HAE), around 2.84% of its 13F portfolio. Nitorum Capital is also relatively very bullish on the stock, setting aside 1.82 percent of its 13F equity portfolio to HAE.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Haemonetics Corporation (NYSE:HAE) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the most outsized position in Haemonetics Corporation (NYSE:HAE). Arrowstreet Capital had $18.5 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $11.3 million investment in the stock during the quarter. The following funds were also among the new HAE investors: Donald Sussman’s Paloma Partners, Michael Gelband’s ExodusPoint Capital, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Haemonetics Corporation (NYSE:HAE) but similarly valued. These stocks are MyoKardia, Inc. (NASDAQ:MYOK), TCF Financial Corporation (NASDAQ:TCF), Western Midstream Partners, LP (NYSE:WES), Life Storage, Inc. (NYSE:LSI), The Descartes Systems Group Inc (NASDAQ:DSGX), Vertiv Holdings Co (NYSE:VRT), and MDU Resources Group Inc (NYSE:MDU). All of these stocks’ market caps are similar to HAE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MYOK | 45 | 1360886 | 12 |

| TCF | 14 | 85082 | -5 |

| WES | 11 | 79571 | -1 |

| LSI | 19 | 137533 | -3 |

| DSGX | 10 | 196345 | 0 |

| VRT | 40 | 747088 | 1 |

| MDU | 21 | 182406 | -4 |

| Average | 22.9 | 398416 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.9 hedge funds with bullish positions and the average amount invested in these stocks was $398 million. That figure was $533 million in HAE’s case. MyoKardia, Inc. (NASDAQ:MYOK) is the most popular stock in this table. On the other hand The Descartes Systems Group Inc (NASDAQ:DSGX) is the least popular one with only 10 bullish hedge fund positions. Haemonetics Corporation (NYSE:HAE) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for HAE is 81.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on HAE as the stock returned 12.9% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Haemonetics Corp (NYSE:HAE)

Follow Haemonetics Corp (NYSE:HAE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.