Keeping this in mind, let’s analyze whether Blueprint Medicines Corporation (NASDAQ:BPMC) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

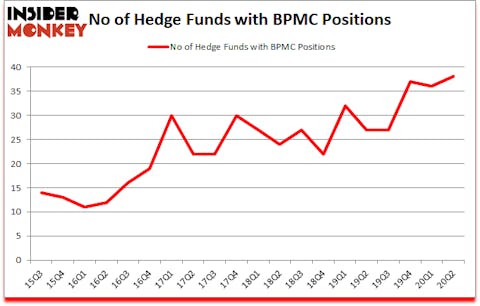

Blueprint Medicines Corporation (NASDAQ:BPMC) has experienced an increase in hedge fund interest of late. Blueprint Medicines Corporation (NASDAQ:BPMC) was in 38 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 37. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 36 hedge funds in our database with BPMC positions at the end of the first quarter. Our calculations also showed that BPMC isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are plenty of gauges market participants can use to evaluate publicly traded companies. Some of the most useful gauges are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the top money managers can trounce the S&P 500 by a superb margin (see the details here).

Andreas Halvorsen of Viking Global

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind let’s take a glance at the recent hedge fund action surrounding Blueprint Medicines Corporation (NASDAQ:BPMC).

What does smart money think about Blueprint Medicines Corporation (NASDAQ:BPMC)?

At the end of June, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the previous quarter. On the other hand, there were a total of 27 hedge funds with a bullish position in BPMC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Blueprint Medicines Corporation (NASDAQ:BPMC) was held by Viking Global, which reported holding $127.1 million worth of stock at the end of June. It was followed by Casdin Capital with a $120.9 million position. Other investors bullish on the company included Hillhouse Capital Management, Cadian Capital, and Rock Springs Capital Management. In terms of the portfolio weights assigned to each position Foresite Capital allocated the biggest weight to Blueprint Medicines Corporation (NASDAQ:BPMC), around 17.31% of its 13F portfolio. Casdin Capital is also relatively very bullish on the stock, dishing out 7.15 percent of its 13F equity portfolio to BPMC.

Now, some big names were breaking ground themselves. Holocene Advisors, managed by Brandon Haley, assembled the most valuable position in Blueprint Medicines Corporation (NASDAQ:BPMC). Holocene Advisors had $41.1 million invested in the company at the end of the quarter. Marc Schneidman’s Aquilo Capital Management also initiated a $24.6 million position during the quarter. The other funds with new positions in the stock are Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management, Neil Shahrestani’s Ikarian Capital, and Louis Bacon’s Moore Global Investments.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Blueprint Medicines Corporation (NASDAQ:BPMC) but similarly valued. We will take a look at Under Armour Inc (NYSE:UA), Starwood Property Trust, Inc. (NYSE:STWD), Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), Youdao, Inc. (NYSE:DAO), Healthequity Inc (NASDAQ:HQY), DXC Technology Company (NYSE:DXC), and Jefferies Financial Group Inc. (NYSE:JEF). This group of stocks’ market caps match BPMC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UA | 40 | 558888 | 3 |

| STWD | 22 | 168439 | -1 |

| NCLH | 28 | 170565 | 8 |

| DAO | 13 | 381255 | 7 |

| HQY | 18 | 164752 | -1 |

| DXC | 40 | 529806 | -1 |

| JEF | 37 | 586275 | 7 |

| Average | 28.3 | 365711 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.3 hedge funds with bullish positions and the average amount invested in these stocks was $366 million. That figure was $1005 million in BPMC’s case. Under Armour Inc (NYSE:UA) is the most popular stock in this table. On the other hand Youdao, Inc. (NYSE:DAO) is the least popular one with only 13 bullish hedge fund positions. Blueprint Medicines Corporation (NASDAQ:BPMC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BPMC is 83.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on BPMC as the stock returned 31.1% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Blueprint Medicines Corp (NASDAQ:BPMC)

Follow Blueprint Medicines Corp (NASDAQ:BPMC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.