In this article we are going to use hedge fund sentiment as a tool and determine whether Avantor, Inc. (NYSE:AVTR) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

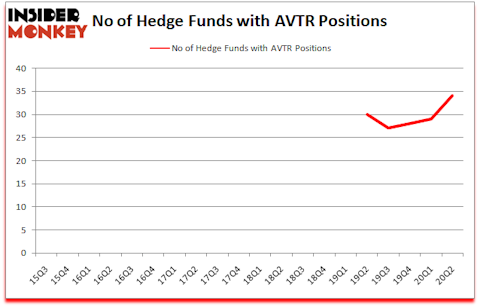

Is Avantor, Inc. (NYSE:AVTR) a bargain? The smart money was taking an optimistic view. The number of long hedge fund bets inched up by 5 lately. Avantor, Inc. (NYSE:AVTR) was in 34 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 30. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that AVTR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are many signals market participants employ to evaluate their holdings. Some of the most useful signals are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the S&P 500 by a solid margin (see the details here).

Ryan Tolkin, CIO of Schonfeld Strategic Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind let’s analyze the recent hedge fund action surrounding Avantor, Inc. (NYSE:AVTR).

How have hedgies been trading Avantor, Inc. (NYSE:AVTR)?

At Q2’s end, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AVTR over the last 20 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Viking Global held the most valuable stake in Avantor, Inc. (NYSE:AVTR), which was worth $93.1 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $86.6 million worth of shares. Maverick Capital, Eminence Capital, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Highside Global Management allocated the biggest weight to Avantor, Inc. (NYSE:AVTR), around 7.2% of its 13F portfolio. Highline Capital Management is also relatively very bullish on the stock, earmarking 6.62 percent of its 13F equity portfolio to AVTR.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Avantor, Inc. (NYSE:AVTR) headfirst. Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, established the largest position in Avantor, Inc. (NYSE:AVTR). Polar Capital had $45.6 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $39.3 million position during the quarter. The other funds with brand new AVTR positions are Renaissance Technologies, Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, and Greg Eisner’s Engineers Gate Manager.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Avantor, Inc. (NYSE:AVTR) but similarly valued. We will take a look at Qiagen NV (NYSE:QGEN), China Southern Airlines Co Ltd (NYSE:ZNH), RPM International Inc. (NYSE:RPM), The Carlyle Group Inc. (NASDAQ:CG), Magellan Midstream Partners, L.P. (NYSE:MMP), ASE Technology Holding Co., Ltd. (NYSE:ASX), and DENTSPLY SIRONA Inc. (NASDAQ:XRAY). This group of stocks’ market caps are similar to AVTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QGEN | 32 | 652397 | 2 |

| ZNH | 2 | 7852 | 0 |

| RPM | 26 | 108615 | 4 |

| CG | 8 | 171536 | -8 |

| MMP | 15 | 59070 | 2 |

| ASX | 11 | 167226 | 2 |

| XRAY | 28 | 1023314 | -2 |

| Average | 17.4 | 312859 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.4 hedge funds with bullish positions and the average amount invested in these stocks was $313 million. That figure was $647 million in AVTR’s case. Qiagen NV (NYSE:QGEN) is the most popular stock in this table. On the other hand China Southern Airlines Co Ltd (NYSE:ZNH) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Avantor, Inc. (NYSE:AVTR) is more popular among hedge funds. Our overall hedge fund sentiment score for AVTR is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 23% in 2020 through October 30th but still managed to beat the market by 20.1 percentage points. Hedge funds were also right about betting on AVTR as the stock returned 36.9% since the end of June (through 10/30) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Avantor Inc. (NYSE:AVTR)

Follow Avantor Inc. (NYSE:AVTR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.