Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of GDS Holdings Limited (NASDAQ:GDS).

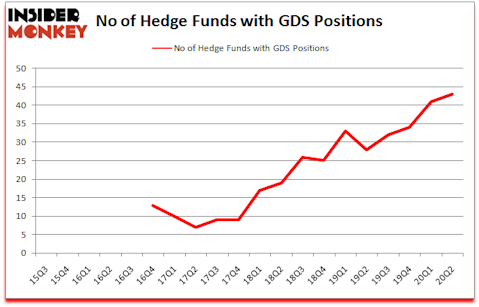

GDS Holdings Limited (NASDAQ:GDS) has experienced an increase in hedge fund sentiment recently. GDS Holdings Limited (NASDAQ:GDS) was in 43 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 41. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 41 hedge funds in our database with GDS positions at the end of the first quarter. Our calculations also showed that GDS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a multitude of metrics shareholders can use to size up their stock investments. A duo of the most innovative metrics are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top fund managers can trounce the S&P 500 by a significant amount (see the details here).

Chase Coleman of Tiger Global

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 best artificial intelligence stocks to pick the best growth stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind let’s take a gander at the recent hedge fund action regarding GDS Holdings Limited (NASDAQ:GDS).

What have hedge funds been doing with GDS Holdings Limited (NASDAQ:GDS)?

At Q2’s end, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards GDS over the last 20 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, 12 West Capital Management, managed by Joel Ramin, holds the number one position in GDS Holdings Limited (NASDAQ:GDS). 12 West Capital Management has a $795.7 million position in the stock, comprising 41.1% of its 13F portfolio. On 12 West Capital Management’s heels is Tiger Global Management LLC, managed by Chase Coleman, which holds a $456.5 million position; 1.8% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism encompass D. E. Shaw’s D E Shaw, Beeneet Kothari’s Tekne Capital Management and Ted Kang’s Kylin Management. In terms of the portfolio weights assigned to each position 12 West Capital Management allocated the biggest weight to GDS Holdings Limited (NASDAQ:GDS), around 41.12% of its 13F portfolio. Kadensa Capital is also relatively very bullish on the stock, dishing out 29.15 percent of its 13F equity portfolio to GDS.

Now, specific money managers have jumped into GDS Holdings Limited (NASDAQ:GDS) headfirst. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, assembled the most valuable position in GDS Holdings Limited (NASDAQ:GDS). LMR Partners had $17.6 million invested in the company at the end of the quarter. Kevin Mok’s Hidden Lake Asset Management also made a $9.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Robert Boucai’s Newbrook Capital Advisors, Panayotis Takis Sparaggis’s Alkeon Capital Management, and Stewart Strawbridge’s Selkirk Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as GDS Holdings Limited (NASDAQ:GDS) but similarly valued. These stocks are Brookfield Infrastructure Partners L.P. (NYSE:BIP), The J.M. Smucker Company (NYSE:SJM), W.P. Carey Inc. (NYSE:WPC), LINE Corporation (NYSE:LN), Catalent Inc (NYSE:CTLT), NVR, Inc. (NYSE:NVR), and HEICO Corporation (NYSE:HEI). This group of stocks’ market values are closest to GDS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIP | 12 | 52792 | -2 |

| SJM | 38 | 673873 | 2 |

| WPC | 23 | 93673 | 1 |

| LN | 8 | 116785 | 1 |

| CTLT | 35 | 490420 | 8 |

| NVR | 39 | 939775 | 5 |

| HEI | 46 | 667415 | 7 |

| Average | 28.7 | 433533 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.7 hedge funds with bullish positions and the average amount invested in these stocks was $434 million. That figure was $2239 million in GDS’s case. HEICO Corporation (NYSE:HEI) is the most popular stock in this table. On the other hand LINE Corporation (NYSE:LN) is the least popular one with only 8 bullish hedge fund positions. GDS Holdings Limited (NASDAQ:GDS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GDS is 83.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and beat the market by 21 percentage points. Unfortunately GDS wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on GDS were disappointed as the stock returned 8% since the end of June (through 10/23) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Gds Holdings Ltd (NASDAQ:GDS)

Follow Gds Holdings Ltd (NASDAQ:GDS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.