Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March. In this article we are going to reveal the smart money sentiment towards Encore Capital Group, Inc. (NASDAQ:ECPG).

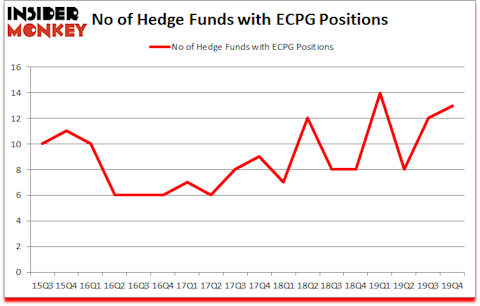

Encore Capital Group, Inc. (NASDAQ:ECPG) has seen an increase in hedge fund sentiment in recent months. Our calculations also showed that ECPG isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with high accuracy, so we check out his stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a peek at the key hedge fund action encompassing Encore Capital Group, Inc. (NASDAQ:ECPG).

Hedge fund activity in Encore Capital Group, Inc. (NASDAQ:ECPG)

Heading into the first quarter of 2020, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from one quarter earlier. By comparison, 8 hedge funds held shares or bullish call options in ECPG a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, BloombergSen was the largest shareholder of Encore Capital Group, Inc. (NASDAQ:ECPG), with a stake worth $27.1 million reported as of the end of September. Trailing BloombergSen was Second Curve Capital, which amassed a stake valued at $16.7 million. D E Shaw, Millennium Management, and Intrinsic Edge Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Second Curve Capital allocated the biggest weight to Encore Capital Group, Inc. (NASDAQ:ECPG), around 8.85% of its 13F portfolio. BloombergSen is also relatively very bullish on the stock, dishing out 1.39 percent of its 13F equity portfolio to ECPG.

As aggregate interest increased, key hedge funds were breaking ground themselves. Intrinsic Edge Capital, managed by Mark Coe, assembled the largest position in Encore Capital Group, Inc. (NASDAQ:ECPG). Intrinsic Edge Capital had $5.7 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $3.1 million position during the quarter. The other funds with new positions in the stock are Cliff Asness’s AQR Capital Management, Michael Gelband’s ExodusPoint Capital, and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks similar to Encore Capital Group, Inc. (NASDAQ:ECPG). These stocks are National Bank Holdings Corp (NYSE:NBHC), Transportadora de Gas del Sur SA (NYSE:TGS), Bright Scholar Education Holdings Limited (NYSE:BEDU), and Plantronics, Inc. (NYSE:PLT). This group of stocks’ market caps match ECPG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBHC | 9 | 83778 | -3 |

| TGS | 10 | 24814 | 1 |

| BEDU | 8 | 87125 | -1 |

| PLT | 11 | 44533 | -2 |

| Average | 9.5 | 60063 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $73 million in ECPG’s case. Plantronics, Inc. (NYSE:PLT) is the most popular stock in this table. On the other hand Bright Scholar Education Holdings Limited (NYSE:BEDU) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Encore Capital Group, Inc. (NASDAQ:ECPG) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st and still beat the market by 12.9 percentage points. Unfortunately ECPG wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on ECPG were disappointed as the stock returned -33.4% during the four months of 2020 (through May 1st) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.