With the second-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the third quarter of 2021. One of these stocks was DexCom, Inc. (NASDAQ:DXCM).

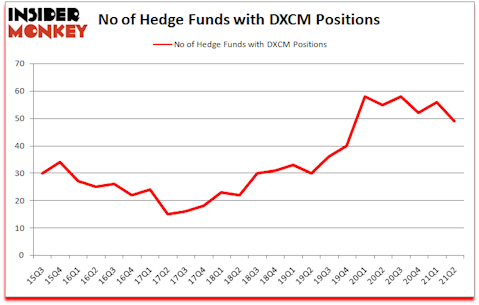

DexCom, Inc. (NASDAQ:DXCM) shareholders have witnessed a decrease in hedge fund sentiment of late. DexCom, Inc. (NASDAQ:DXCM) was in 49 hedge funds’ portfolios at the end of June. The all time high for this statistic is 58. Our calculations also showed that DXCM isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most stock holders, hedge funds are viewed as worthless, old investment tools of the past. While there are greater than 8000 funds with their doors open today, Our experts choose to focus on the masters of this group, approximately 850 funds. These investment experts shepherd most of the smart money’s total capital, and by tracking their best equity investments, Insider Monkey has identified a number of investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Donald Sussman of Paloma Partners

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, billionaire John Paulson is loading up on the miners, so we are checking out stock pitches like this mining stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to take a gander at the latest hedge fund action encompassing DexCom, Inc. (NASDAQ:DXCM).

Do Hedge Funds Think DXCM Is A Good Stock To Buy Now?

At the end of June, a total of 49 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DXCM over the last 24 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

The largest stake in DexCom, Inc. (NASDAQ:DXCM) was held by Lone Pine Capital, which reported holding $797.8 million worth of stock at the end of June. It was followed by Holocene Advisors with a $140.9 million position. Other investors bullish on the company included Citadel Investment Group, OrbiMed Advisors, and Redmile Group. In terms of the portfolio weights assigned to each position Parkman Healthcare Partners allocated the biggest weight to DexCom, Inc. (NASDAQ:DXCM), around 4.71% of its 13F portfolio. Engine No. 1 LLC is also relatively very bullish on the stock, dishing out 4.21 percent of its 13F equity portfolio to DXCM.

Due to the fact that DexCom, Inc. (NASDAQ:DXCM) has experienced falling interest from the smart money, it’s easy to see that there lies a certain “tier” of hedgies that elected to cut their entire stakes in the second quarter. Intriguingly, Renaissance Technologies said goodbye to the largest investment of the 750 funds tracked by Insider Monkey, valued at an estimated $51.8 million in stock, and David Costen Haley’s HBK Investments was right behind this move, as the fund dumped about $48.3 million worth. These moves are important to note, as total hedge fund interest was cut by 7 funds in the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as DexCom, Inc. (NASDAQ:DXCM) but similarly valued. We will take a look at Kinder Morgan Inc (NYSE:KMI), DuPont de Nemours Inc (NYSE:DD), Electronic Arts Inc. (NASDAQ:EA), American International Group Inc (NYSE:AIG), Barclays PLC (NYSE:BCS), Microchip Technology Incorporated (NASDAQ:MCHP), and Amphenol Corporation (NYSE:APH). This group of stocks’ market caps are similar to DXCM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KMI | 38 | 1032764 | 0 |

| DD | 57 | 1653192 | 8 |

| EA | 56 | 2022602 | 12 |

| AIG | 39 | 2744991 | 6 |

| BCS | 11 | 119955 | 1 |

| MCHP | 50 | 1121112 | 8 |

| APH | 39 | 1203614 | -3 |

| Average | 41.4 | 1414033 | 4.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.4 hedge funds with bullish positions and the average amount invested in these stocks was $1414 million. That figure was $1634 million in DXCM’s case. DuPont de Nemours Inc (NYSE:DD) is the most popular stock in this table. On the other hand Barclays PLC (NYSE:BCS) is the least popular one with only 11 bullish hedge fund positions. DexCom, Inc. (NASDAQ:DXCM) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DXCM is 64.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 through November 5th and still beat the market by 3.1 percentage points. Hedge funds were also right about betting on DXCM as the stock returned 48.8% since the end of Q2 (through 11/5) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Dexcom Inc (NASDAQ:DXCM)

Follow Dexcom Inc (NASDAQ:DXCM)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Future Food Stocks to Invest in Today

- 10 Best Insurance Stocks To Buy Now

- 30 Most Affordable Major Cities in the U.S.

Disclosure: None. This article was originally published at Insider Monkey.