Del Principe O’Brien Financial Advisors recently released its third-quarter investor letter – a copy of which is available for download here. The fund posted a return of 8.6% for the quarter, underperforming its benchmark, the S&P 500 Index which returned 8.9% in the same quarter. You should check out Del Principe O’Brien Financial Advisors top 5 stock picks for investors to buy right now, which could be the biggest winners of 2021.

In the Q3 2020 Investor Letter, Del Principe O’Brien Financial Advisors highlighted a few stocks and Berkshire Hathaway Inc (NYSE:BRK.B) is one of them. Berkshire Hathaway Inc (NYSE:BRK.B) is a multinational conglomerate holding company. Year-to-date, Berkshire Hathaway Inc (NYSE:BRK.B) stock lost 0.8% and on December 17th it had a closing price of $224.68. Here is what Del Principe O’Brien Financial Advisors said:

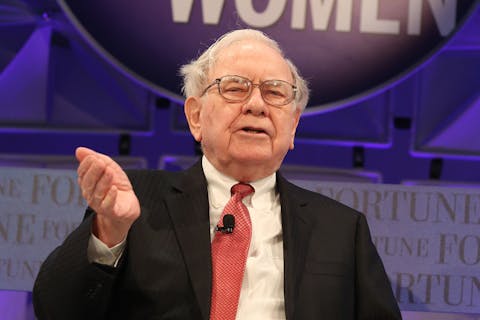

“Warren Buffett is, of course, the king of serial acquirers. He has grown his massive holding company, Berkshire Hathaway, by relentlessly deploying capital toward strategic acquisitions. In July, Berkshire entered an agreement to buy all of Dominion Energy’s Gas Transmission & Storage segment. The nearly all-cash deal, which is set to close in Q4 2020, is valued at close to $10 billion, including $5.7 billion of existing debt. Being so over-levered, Dominion was on the verge of filing for bankruptcy. That Berkshire had the cash and was able to make the purchase is what we call “good mojo” and a true win-win: Dominion was not forced to enter into bankruptcy, and the acquisition of Dominion’s business makes Berkshire one of the largest energy companies in the world.

According to its second quarter report, Berkshire realized $15.7 billion in proceeds from equity sales for a total of $146.6 billion in cash and equivalents on hand. That was in spite of the $5.1 billion worth of stock the company repurchased in May and June (the largest ever repurchase in a single time period for Buffett). In the second quarter alone, Berkshire reported $26.3 billion in net earnings. The company is strong and getting stronger.”

Krista Kennell/Shutterstock.com

Last month, we published an article revealing that Berkshire Hathaway Inc (NYSE:BRK.B) was one of the top 10 stocks just bought by Warren Buffett.

In Q3 2020, the number of bullish hedge fund positions on Berkshire Hathaway Inc (NYSE:BRK.B) stock increased by about 2% from the previous quarter (see the chart here), so a number of other hedge fund managers believe in Berkshire Hathaway’s growth potential. Our calculations showed that Berkshire Hathaway Inc (NYSE:BRK.B) is ranked #15 among the 30 most popular stocks among hedge funds.

The top 10 stocks among hedge funds returned 216% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 121 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Below you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

Video: Top 5 Stocks Among Hedge Funds

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website:

Disclosure: None. This article is originally published at Insider Monkey.