The company is seen as the “pure play” on metallurgical coal used in the making of steel. It benefited greatly from the surging demand in China that has peaked in the last year, sending met coal prices lower and the company into disarray due to liquidity fears.

The question is whether the stock has any value now that it is only worth $850 million after having a market cap closer to $9 billion when the decade was just starting. Typical of the stock market, it likely overshot on the upside and is now overshooting to the downside.

Shocking collapse

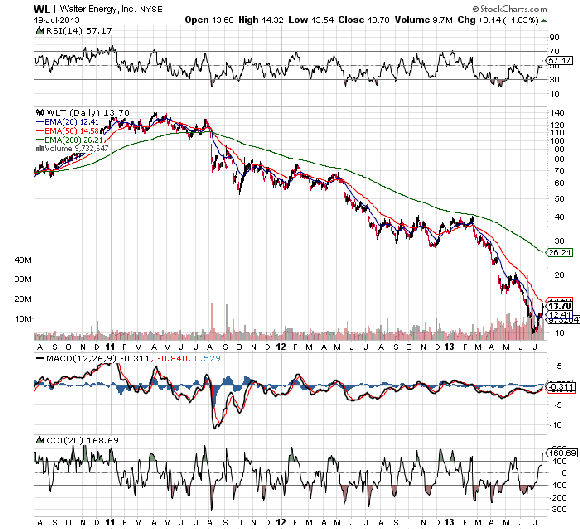

The stock peaked around $140 back in April of 2011 and collapsed on the way to of $9.88 in June of this year. In a time period of two years, the stock lost 93% of its value.

Stock Chart – 3 Year

The collapse, while spectacular, was such an industry-wide phenomenon that Cliffs Natural Resources Inc (NYSE:CLF) and Alpha Natural Resources, Inc. (NYSE:ANR) both saw similar declines. As with Walter Energy, Inc. (NYSE:WLT), both stocks supply commodities for the steel industry with Cliffs Natural Resources Inc (NYSE:CLF) focused on iron ore and Alpha Natural Resources, Inc. (NYSE:ANR) on met coal as well. The below 10-year chart shows the potential returns if the segment was to come roaring back on emerging market demand.

Slashing dividend and refinancing

According to a Bloomberg report, Walter Energy, Inc. (NYSE:WLT) is negotiating an amendment to a debt financing that will likely result in the cutting of the dividend and potentially increase interest rates. Considering the financial situation that the company finds itself in, a dividend cut would actually appear prudent. Apparently the company is close to exceeding the leverage requirements for its senior secured debt, which could be disastrous if it was unable to alter terms. Though more concerning might be a increase in the interest rates on top of an already $40 million in quarterly interest cash costs.

Encouraging signs

While some of the year-over-year numbers are still depressing, the company is making great progress in reducing costs while maintaining strong production. In fact, the company forecasted a 5% reduction in costs of production and sales during Q2 with a significant improvement to earnings, adjusted EBITDA, and cash flows.

With around $2.6 billion in debt, it will be crucial to reach those targets. The major reason for the earnings collapse was a revenue base that shrunk $140 million while costs of sales only declined roughly $10 million. Not counting the higher depreciation and depletion total, expenses were actually flat compared to last year, a further sign of the massive leverage in the business if met coal prices were to rebound.

Comparative valuations

All three stocks are now saddled with enterprise values that are made up primarily from debt levels. Alpha Natural Resources, Inc. (NYSE:ANR) and Cliffs Natural Resources Inc (NYSE:CLF) provide better enterprise value to EBITDA ratios. While Walter Energy, Inc. (NYSE:WLT) trades at an enterprise value of over 10 times the trailing EBITDA, Alpha Natural and Cliffs trade at around 4 times EBITDA ratios. Of course, the market will be more concerned about what these companies can achieve via cost reductions as pricing is expected to remain low for an extended period.

Bottom line

While demand for steel-making commodities in China, Europe and around the globe has slowed down, part of the issue is higher supply of met coal from Mongolia and South Africa. An aggressive investor might want to look into Walter Energy, Inc. (NYSE:WLT) for another massive gain as in both the 2008 and 2011 periods. Both Alpha Natural and Cliffs provide the more conservative way of playing a rebound in the commodities needed for steel making. The world has not stopped developing, and these commodities will ultimately have value beyond the current levels.

The article Walter Energy Is Worth How Much? originally appeared on Fool.com and is written by Mark Holder.

Mark Holder and Stone Fox Capital Advisors, LLC own shares in Alpha Natural Resources. The Motley Fool has no position in any of the stocks mentioned. Mark is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.