Retail sales have been generally weak as of late, with the biggest bright spots being automobiles and home improvement retailers. While retail giants Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT) missed earnings in the last quarter, warehouse club Costco Wholesale Corporation (NASDAQ:COST) seems completely unaffected by the current retail malaise. Are shares of Costco the clear choice in retail, or have strong results driven the price up too high?

Difficult to compare

Costco Wholesale Corporation (NASDAQ:COST) has a starkly different business model from traditional retailers. Customers must pay an annual membership fee, currently $55, in order to shop at Costco. The company reported a comparable-store sales increase of 5% last quarter, far better than its competitors, but the profit derived from these sales is small. Operating income for the quarter was $722 million, but $531 million of this came from membership fees. Less than $200 million of operating income came from the actual sales of over $23.5 billion in products.

While the comparable-store results are impressive, they mean little in terms of profitability. Membership fees grew by 11.8% year-over-year, and at the end of the quarter there were 69.9 million members worldwide.

How big can Costco get?

Costco Wholesale Corporation (NASDAQ:COST) operates a total of 629 warehouses worldwide, so it seems there is plenty of room for future growth. There are some issues with Costco’s business model, however. In order to drive down costs, Costco severely limits the number of brands it carries. While a traditional grocery store may have dozens of different types of ketchup, for example, Costco carries just Heinz. While this eliminates decisions for the customer, it alienates those with specific preferences.

While Costco Wholesale Corporation (NASDAQ:COST) currently sells around $100 billion in products annually, there’s no reason why growth can’t continue for many years. For the above reasons, however, I don’t believe that Costco can match Wal-Mart Stores, Inc. (NYSE:WMT)’s scale. With all of the good news and strong results over the last few years, it seems more likely than not that shares of Costco are too expensive relative to future growth.

Any value in big retail?

When comparing companies in the same industry, the price-to-sales ratio can be useful. However, Costco complicates the picture in two ways. First, Costco Wholesale Corporation (NASDAQ:COST) is growing faster than both Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT), therefore deserving a higher ratio. Second, Costco has lower margins than Wal-Mart and Target, therefore deserving a lower ratio. Because of this, comparing Costco directly with its peers likely doesn’t give a meaningful result. However, looking at Costco’s historical price-to-sales ratio may provide some insight:

Costco PS Ratio (Annual) data by YCharts

From the early 2000’s to just before the financial crisis, the P/S ratio was roughly flat, averaging around where the ratio sits today. This leads me to believe that Costco has reached a point where further growth in the stock price will be roughly proportional to revenue growth, as further expansion in the P/S ratio seems like a stretch.

Unlike Costco, Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT) have faced bad news and poor short-term conditions lately. Often, the best time to buy a stock is when short-term prospects are poor but long-term prospects are solid. This tends to create opportunities for long-term-oriented investors in the form of depressed prices.

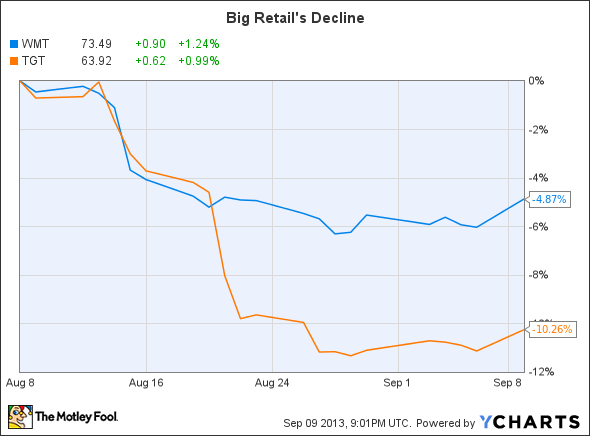

After poor earnings reports from both Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT) in August, the stock prices for both have fallen significantly.

Wal-Mart Stores, Inc. (NYSE:WMT) reported a same-store sales decline of 0.3% last quarter, with net income basically flat from a year ago. The company blamed both a shaky economy and the rise in payroll taxes to normal levels for the disappointing results, lowering its sales guidance to 2%-3% from 5%-6% previously. Also, protests over the low wages Wal-Mart pays its employees are getting a lot of press, although it’s unclear whether a considerable number of actual employees are participating.

All of these issues are driving shares lower, but the long-term picture is relatively unchanged. Wal-Mart Stores, Inc. (NYSE:WMT) earned $5.02 per share last year, putting the current stock price at about 14.6 times earnings. The stock has run up considerably since 2011, but for a long-term investor Wal-mart offers a reasonable price. It’s certainly no bargain, but it’s not overpriced either.

Target Corporation (NYSE:TGT)’s stock has fallen even further than Wal-Mart Stores, Inc. (NYSE:WMT)’s, even though the company reported a comparable-store sales increase of 1.2%. Target faces many of the same short-term problems faced by Wal-Mart, and an aggressive expansion into Canada also suppressed profits. Target opened 44 Canadian stores in the quarter, bringing the total up to 68, with a year-end goal of 124. Earnings-per-share for the quarter fell by 10% year-over-year, causing many focused on the short-term to sell.

The share price drop erases most of the gains achieved this year, with the stock now trading at 14.1 times last year’s earnings. Earnings may decline this year, but the long-term picture is largely unchanged. Target Corporation (NYSE:TGT) isn’t nearly as big as Wal-Mart Stores, Inc. (NYSE:WMT), and the expansion into Canada will eventually pay off.

The bottom line

With good news and strong results, shares of Costco have become expensive. Buying the shares at the current price will likely lead to at best average returns. Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT), both facing short-term issues, look more attractive as the long-term picture is being clouded by the short-term picture.

Target Corporation (NYSE:TGT) looks like the best buy of the three, with the stock being severely punished for a costly expansion which will eventually pay off. The best time to buy a stock is when short-term issues cause an overreaction, and this seems to be the case with Target.

The article Are There Any Deals in Big Retail? originally appeared on Fool.com.

Timothy Green has no position in any stocks mentioned. The Motley Fool recommends Costco Wholesale. The Motley Fool owns shares of Costco Wholesale.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.