Wal-Mart Stores, Inc. (NYSE:WMT) is the largest discount retailer in the world. The company has generated $485.6 billion in sales over the last 12 months. Wal-Mart has profits of $15.5 billion in the same time period.

The table below compares Wal-Mart’s size to its largest competitors in the United States:

| Company | Revenue | Earnings | Profit Margin |

| Wal-Mart | $485.6 billion | $15.5 billion | 3.2% |

| Costco | $115.9 billion | $2.3 billion | 2.0% |

| Amazon | $95.8 billion | -$0.2 billion | -0.2% |

| Target | $72.7 billion | $3.2 billion | 4.4% |

Wal-Mart generates 70% more sales than Costco (COST), Amazon (AMZN), and Target (TGT) combined. Wal-Mart generates 192% more profit than Costco, Amazon, and Target combined. Only Target has a higher profit margin than Wal-Mart of these large discounters.

The table above clearly demonstrates that Wal-Mart operates on a different scale than its rivals. Despite being the undisputed industry leader, Wal-Mart is the cheapest of these businesses.

Amazon doesn’t have a price-to-earnings ratio, but even if it was profitable, it is trading at a lofty valuation. Click here to see Wal-Mart and Amazon compared in detail.

Target currently has a price-to-earnings ratio of 15.1, and Costco has a price-to-earnings ratio of 25.2. Compare this to Wal-Mart’s price-to-earnings ratio of just 13.4… Wal-Mart looks cheap compared to its peers. Another reason why we are interested in Wal-Mart is that billionaires Warren Buffett and Bill Gates are the top 2 holders of the stock in Insider Monkey’s hedge fund database.

Now Is The Best Time to Buy Wal-Mart In the Last Decade

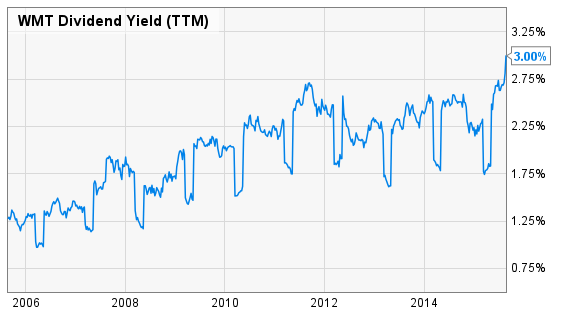

The image below shows Wal-Mart’s dividend yield over the last decade.

As you can see Wal-Mart has never had as high a dividend yield as it does now. The company is currently yielding 3.0% – well above the S&P 500’s dividend yield of 2.2%.

Investing in high quality businesses when they are at their maximum historical dividend yield tends to produce fantastic long-term results.

Wal-Mart’s price has declined 11.1% in the last week. Some of this decline is due to the market panic we have seen in recent days. Still more of the decline is due to Wal-Mart’s weak earnings results which the company recently released.

Wal-Mart’s reduced its guidance for its full fiscal year from a range of $4.70 – $5.05 to a range of $4.40 – $4.70. The decline is due to:

- Higher than expected employee compensation (due to wage increases)

- Higher than expected ‘shrink’ (basically, inventory theft)

- Lower than expected pharmacy reimbursements

Despite the negatives, Wal-Mart has turned the corner in the United States – the company delivered 4.8% sales growth in the United States in its most recent quarter.

Comparable store sales grew 1.5% overall. Neighborhood market comparable store sales grew over 7%. Positive comparable store sales growth shows that more people are choosing to spend money at Wal-Mart.

The recent guidance reduction gives investors an excellent entry point into Wal-Mart. Wal-Mart is uniquely situated to perform well if we enter into a global recession.

Great Recession Performance

Wal-Mart performed exceptionally well during the Great Recession of 2007 to 2009. The company’s earnings-per-share each year through this difficult time are shown below:

- 2007 earnings-per-share of $3.16

- 2008 earnings-per-share of $3.42

- 2009 earnings-per-share of $3.66

For comparison, take a look at the earnings-per-share of the S&P 500 over the same time period:

- 2007 earnings-per-share of $75.20

- 2008 earnings-per-share of $16.89 (ouch!)

- 2009 earnings-per-share of $56.33

As you can see, Wal-Mart rolled through the Great Recession as if it didn’t’ even happen. The average business in the S&P 500 suffered significant earnings declines.

The reason Wal-Mart Stores, Inc. (NYSE:WMT) did so well during the Great Recession is its reputation for low prices. When hard times set in, consumers stretch their dollars farther. Wal-Mart has a reputation for selling merchandise at ‘every day low prices’.

The Next Recession

The global economy looks shakier now than at any point since the Great Recession. There is turmoil across the globe – both political and economic.

What’s even more troublesome is that central banks have not yet ‘reloaded’ from the Great Recession of 2007 to 2009, and the recent struggles of the Euro zone. Interest rates are still near historical lows, the central banks of China and Japan are actively buying stocks (if this isn’t irrational bubble behavior, I don’t know what is), and inflation is ravaging many currencies around the world. It is hard to think that more ‘quantitative easing’ will really pull us out of another recession.

If things do continue to get worse – you can do much worse than have your money invested in the world’s largest discount retailer. In 2008, The S&P 500 fell 37.0%… Wal-Mart stock gained 21.6% due to higher earnings and an influx of investors fleeing to one of the only businesses that was still thriving.

Final Thoughts

Wal-Mart’s recent sell-off from its earnings miss gives investors another chance to load up on one of the world’s most recession resistant stocks.

It is a fool’s errand to predict when the next recession will occur. An analysis of current macroeconomic events points to a recession happening sooner rather than later, but things could always change.

With Wal-Mart Stores, Inc. (NYSE:WMT), investors can hedge for a recession while still owning a businesses that has paid increasing dividends for over 4 decades.

I don’t know when the next recession will occur. Whether it does or not, I feel very comfortable holding shares of Wal-Mart – especially with a 3.0% dividend yield and a price-to-earnings ratio of just 13.4.

Disclosure: None