On the list of investors’ needs these days, income is at or near the top. Yet, as the market has gone up and up for six months straight, income opportunities have diminished.

On the other hand, investors are duly worried that once central bank support tapers off and interest rates go up, many other dividend-paying stocks will crash along with bonds. This will be especially true for dividend payers who do not substantially grow their payouts, such as utilities.

In this article, I will look at three major telecoms that still offer a good dividend yield, are well-managed, and even have some growth prospects. I believe earnings and dividend growth will be a shield against rising rates and falling bonds because bonds do not increase their coupon payments. Companies with some dividend growth will, therefore, not trade in lockstep with these bonds. All three of the telecoms listed here have grown their dividend payouts.

Vodafone Group Plc (ADR) (NASDAQ:VOD) – Global carrier with diverse exposure

Dividend yield: 4.80%

Vodafone is a U.K.-based telecommunications carrier. Its biggest markets is in the U.K. and continental Europe. It also has large markets in India, Egypt, Turkey, South Africa, Ghana, and a number of other places. Vodafone owns 45% of Verizon‘s wireless division. Despite their exposure to an interesting array of emerging markets, Europe is the largest chunk of its revenue and the recession there has weighed on the top and bottom line.

Vodafone Group Plc (NASDAQ:VOD) Preliminary Results, May 21, 2013

.

The revenue chart above shows a drop in in MTR (Mobile Termination Rates), voice, and messaging. Europe’s decline more than offset growth in emerging markets. Data has been a bright spot and this should continue as smartphone use continues to spread. Although there is a total decline for the group, revenue actually increased 1.2% for the year when Verizon’s contribution is factored in.

Of the three telecoms listed, Vodafone Group Plc (ADR) (NASDAQ:VOD) has the highest debt and the least growth. While revenue has grown slightly this year, Vodafone’s four-year track record of Free Cash Flow growth is the lowest of the three. For this reason, Vodafone is number three on my conviction list.

China Mobile Ltd. (ADR) (NYSE:CHL) – Pristine balance sheet pays you to wait

Dividend yield: 3.95%

P/E Ratio: 10.8

China Mobile may be listed in Hong Kong, but it is actually a provider of telecommunications in mainland China. By subscribers and revenue, it is the biggest telecom in the world.

China Mobile may be listed in Hong Kong, but it is actually a provider of telecommunications in mainland China. By subscribers and revenue, it is the biggest telecom in the world.

While Chinese consumers are spending more and more on telecommunications, China Mobile is yet to benefit much from this trend in the last three years. While dominant in “plain vanilla” voice and text messaging, their 3G standard is not compatible with some of the more popular smartphones. This has caused many new 3G subscribers to migrate over to the other two carriers, both of whom operate on more globally accepted technology. Many believe that China Mobile Ltd. (ADR) (NYSE:CHL)’s 3G is not even profitable.

China Mobile ltd, 2012 Annual Results Presentation, March 2013

.

Nevertheless, China Mobile is still slowly adding to its top and bottom lines, as we can see in the graphic. Their voice and messaging business continues to grow in lower-income, rural parts of the country. But the reason to consider China Mobile Ltd. (ADR) (NYSE:CHL) is actually its new 4G platform, called TD-LTE, which is scheduled to be launched some time this year. Unlike its 3G standard, TD-LTE should be compatible with most popular smartphones, allowing China Mobile to finally begin benefiting from the migration to wireless data in China.

China Mobile’s dividend yield is considerably lower than the other two, which what keeps it at number two on my conviction list. However, with a P/E ratio of only 10.6 , the stock is much cheaper than Vodafone Group Plc (ADR) (NASDAQ:VOD) or AT&T (NYSE:T) (the next stock on the list). And for a telecom, China Mobile Ltd. (ADR) (NYSE:CHL)’s balance sheet has remarkably little debt. With a healthy dividend, some growth, and the potential for more growth going forward, China Mobile makes a strong case for itself to the income-minded investor.

AT&T Inc. (NYSE:T) – Slow, steady growth in the U.S.

Dividend yield: 4.80%

P/E Ratio: 21.3

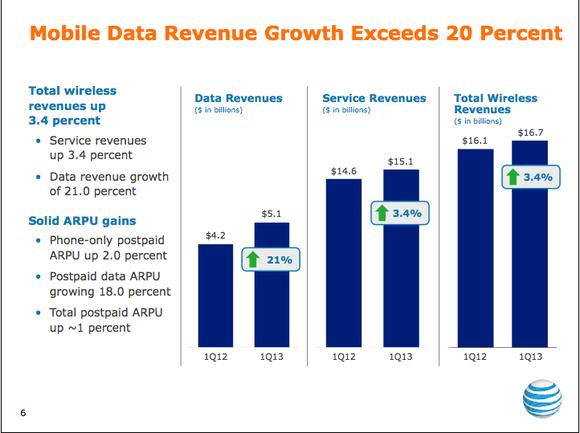

AT&T is the largest telecommunications provider in the United States. It is growing steadily and predictably. Much like Vodafone, this growth is led by wireless data. But unlike Vodafone Group Plc (ADR) (NASDAQ:VOD), AT&T Inc. (NYSE:T) does not have to contend with a drastically shrinking southern European market.

AT&T is the largest telecommunications provider in the United States. It is growing steadily and predictably. Much like Vodafone, this growth is led by wireless data. But unlike Vodafone Group Plc (ADR) (NASDAQ:VOD), AT&T Inc. (NYSE:T) does not have to contend with a drastically shrinking southern European market.

AT&T 1Q13 Earnings Conference Call, April 23, 2013

.

With a dividend yield of 4.80%, manageable debt levels, and a stable market, AT&T represents a happy medium between China Mobile and Vodafone Group Plc (ADR) (NASDAQ:VOD). Although debt levels are higher than China Mobile Ltd. (ADR) (NYSE:CHL), AT&T Inc. (NYSE:T)’s growth is more reliable and does not require a structural change in its business. It also has roughly the same dividend yield as Vodafone, but with a much steadier, domestic growth picture. At 21.3 times earnings, it is trading above its “normal” price to earnings ratio of 18.7. Still, AT&T is at the top of my conviction list for its fundamentals.

Conclusion: a Comparison between the three

Free Cash Flow is an important metric for telecoms because it can be readily converted into dividends. Of the three telecoms, only Vodafone has not been able to grow Free Cash Flow since 2009, (these numbers do not include their stake in Verizon, which would likely make Vodafone Group Plc (ADR) (NASDAQ:VOD)’s Free Cash Flow numbers positive). Both China Mobile Ltd. (ADR) (NYSE:CHL) and AT&T Inc. (NYSE:T) have grown cash flow steadily.

Looking at debt relative to Free Cash Flow, we see that China Mobile has a clear advantage over the other two. Despite the lower dividend yield, a low P/E ratio and clean balance sheet make China Mobile Ltd. (ADR) (NYSE:CHL) a conservative choice. While AT&T Inc. (NYSE:T) may have more debt, its higher yield and steady growth will deliver predictable income and provide some protection against possibly rising rates. Dividend investors should consider all three companies and choose the one which best suits their needs.

Sources:

All price charts by stockcharts.com

“Free Cash Flow,” and “Debt/Free Cash Flow” charts by author, data by Morningstar

Casey Hoerth is long Vodafone and China Mobile. The Motley Fool recommends Vodafone. The Motley Fool owns shares of China Mobile.

The article These 3 Telecoms Provide Income, Stability, and a Little Growth originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.