The best businesses are those that have implicit monopoly power. They can earn high returns on capital without sacrificing quality to beat their customers on price. Implicit monopolies aren’t constrained like explicit monopolies, either.

This rapidly-growing dot com is slowly building an impenetrable monopoly.

Bank on printing

VistaPrint Limited (NASDAQ:VPRT) is a leader in the online printing space. The company offers inexpensive products meant for business customers. From promotional pens to business cards and letterhead, the company uses its scale and pricing to beat out local competitors for a greater share of the promotional market.

Vistaprint has found its niche in “microbusinesses,” which are small, often one-man startups that need essential supplies for a small office. Microbusiness owners can purchase everything they need at VistaPrint Limited (NASDAQ:VPRT) to make their one-man shop look as official as a multinational corporation.

This fast-growing niche rewards the company with impressive top-line growth. In the quarter ended March 31, 2013, the company reported revenue growth of 12% year-over-year in constant currency terms, while projecting full year growth of 17% year over year.

At nearly 200,000 orders per day in the second quarter, VistaPrint Limited (NASDAQ:VPRT) is a sure leader in the space. It’s also maturing. The company reduced its aggressive cross-promotional marketing to invest in the consumer. Customers were turned off by the company’s non-stop email campaigns and checkout upsells, which it has since removed from the site. The move should help retain customers who simply want a simple step-by-step purchase of necessary office supplies.

Massive bottom line growth potential

VistaPrint Limited (NASDAQ:VPRT) operates in a very competitive industry. Open your local phone book or search Google for promotional companies near you – you’ll find hundreds in a city of any true size.

With competition comes margin compression. The biggest cost this industry faces is the cost of customer acquisition. Financial supplements reveal that as a percentage of revenue, marketing and selling costs are higher than the cost of each product.

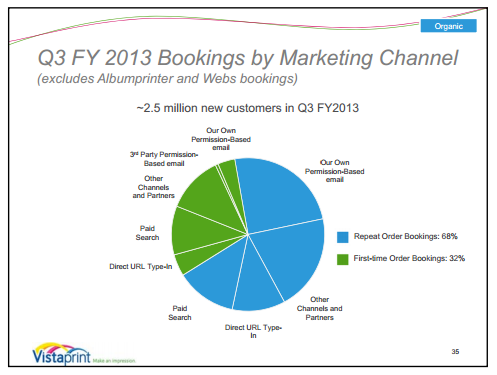

The high cost of customer acquisition may soon level off, however, as the company’s growth phase ends and repeat orders make up significantly more of its quarterly revenue. Here’s a chart of its advertising costs and cost of customer acquisition over time:

The company’s investments in its customer may soon pay off, however. In another slide, VistaPrint Limited (NASDAQ:VPRT) reveals that its type-in customers (those who go directly to the site by typing the domain name into their browser) are a rapidly-growing portion of its customer base.

As more customers come to the site via direct type in, its advertising costs should plummet, leading to rapidly growing margins. Remember, advertising takes 25 cents of every $1 of the company’s revenue. If in five years its marketing could be cut by 20% (hardly a big change, given the large share of search spending in its budget) the company’s income from operations would more than double.

Not to mention, its repeat customers spend substantially more per order than its new customers ($98 vs. $50 in the first quarter of 2013).

Growing in brick and mortar locations

VistaPrint Limited (NASDAQ:VPRT) isn’t just an online company. The ability through which executives have formed long-lasting, market share-stealing partnerships is exceptional. Vistaprint quietly receives outsourced projects from Staples, Inc. (NASDAQ:SPLS) and FedEx Office. A partnership with Staples is a sign that Vistaprint can beat the pricing power of a worldwide office supply store with more than 2,000 retail stores.