Andreas Halvorsen’s Viking Global started a new position in Avis Budget Group Inc (NASDAQ:CAR) with 5,346,199 shares. Following this transaction, the investment firm now holds Common Shares representing 5% of the company’s outstanding stock. In addition, Larry Robbins’ Glenview Capital increased its stake in Avis Budget Group by 1,497,500 shares, increasing its exposure to the stock by 37.9%.

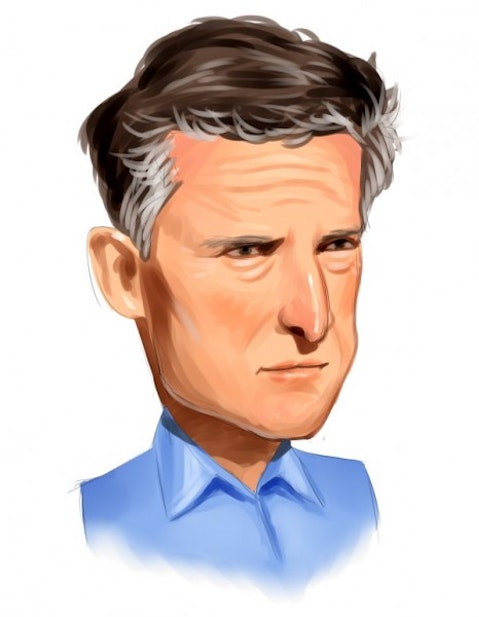

Viking Global was founded in 1999 by the Norwegian Andreas Halvorsen, along with former Tiger employees David Ott and Brian Olson. The global equity fund employs a bottom-up stock picking approach and has an equity portfolio valued at around $24.9 billion. Viking Global has demonstrated a preference for healthcare, services, and basic materials stocks, while diversifying the rest of its assets. The recent addition of Avis Budget Group Inc (NASDAQ:CAR) to its equity portfolio, suits the fund quite well, especially as the stock has seen some interesting growth throughout 2014. In the past few days, share prices have been growing due to the disclosure put forward by Glenview Capital, which saw its holdings in the company increase.

Avis Budget Group Inc (NASDAQ:CAR) is an $11.55 billion market cap provider of car and truck rentals, car sharing, and ancillary services to businesses and consumers worldwide. Along with its subsidiaries, the company operates the Avis car rental system with approximately 5,450 locations, which are divided into three segments: North America, International, and Truck Rental. Founded in 1946, the New Jersey-based entity has grown far beyond its initial purpose, and currently provides a range of optional insurance products and coverages, such as supplemental liability insurance, personal accident insurance, personal effects protection, physical damage waivers, automobile towing protection, and cargo insurance. Avis stock has thus not only become sought-after due to hedge fund activity, but also thanks to a long-standing and successful business model. In addition, the stock has benefitted from the increase in rental prices implemented by rival car rental firm Hertz Global Holdings Inc (NYSE:HTZ).

Apart from Viking Global and Glenview Capital, a wide range of institutional shareholders remain bullish regarding Avis Budget Group Inc (NASDAQ:CAR). Karthik Sarma’s Srs Investment Management disclosed a stake of 10 million shares last quarter, valued at over $548 million and representing 21.95% of the firm’s equity portfolio.Brian Jackelow’s Sab Capital Management is another Avis bull: the fund disclosed holdings of more than 4.15 million shares last quarter, after increasing its exposure by 108%. The funds mentioned above are certainly betting on the company to succeed, especially Viking Global, which recently purchased a very large new position. Even David Cohen and Harold Levy’s Iridian Asset Management, which shed around 1.9 million shares last quarter, continues to maintain a large stake in Avis of more than 4.39 million shares.

Disclosure: Pablo Erbar holds no positions in any stocks or funds mentioned.