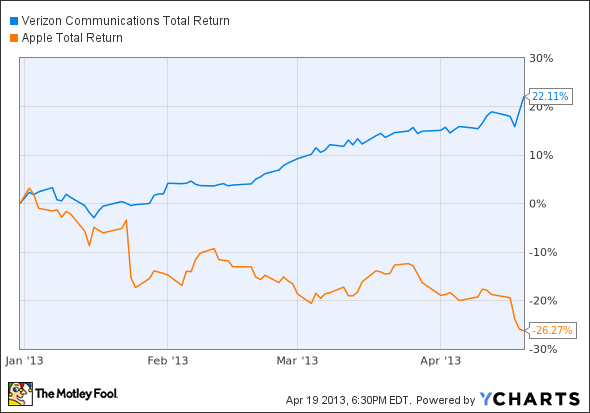

Meanwhile, smartphone and tablet extraordinaire Apple Inc. (NASDAQ:AAPL) has faced a deluge of negativity over the past several months, most recently closing out last week by setting three consecutive 52-week-lows. All told, Cupertino’s year-to-date performance hasn’t fared much better:

VZ Total Return Price data by YCharts

Curiously enough, Verizon Communications Inc. (NYSE:VZ) also just told us that 4 million of the 7.2 million smartphones it sold in the first quarter were Apple’s iPhones, and facing competition from the likes of Samsung with its massively popular Galaxy series devices, to take home more than half of Big Red’s total smartphone sales is no small feat.

Unfortunately for Apple Inc. (NASDAQ:AAPL), just half of those 4 million Apple Inc. (NASDAQ:AAPL) devices Verizon Communications Inc. (NYSE:VZ) sold were iPhone 5s, with the remaining half consisting of the older iPhone 4 and 4S models. Of course, that’s consistent with last quarter’s split, when many investors had thought (or hoped, rather) that the iPhone 5 was simply in short supply.

Yet here we are looking back at another 50/50 split in Q1, when Apple’s fresh supply of iPhone 5s should have had no trouble keeping up with demand. So does this mean consumers are underwhelmed with Apple Inc. (NASDAQ:AAPL)’s latest offering?

Perhaps.

That doesn’t do much to reassure nervous Apple investors who are praying for a blowout quarter to turn things around.

Apple iPhone 5, Image Source: Apple Inc. (NASDAQ:AAPL)

The silver lining

Then again, while this all seems to show that consumers aren’t particularly compelled to pay up for the iPhone 5, the fact so many people want an iPhone at all — new or old — undoubtedly shows impressive interest in taking part in Apple’s world-class software ecosystem. After all, when so many people we interact with on a daily basis already have Apple Inc. (NASDAQ:AAPL)’s products, network-effect-based applications such as iMessage and FaceTime start to look a whole lot more interesting.

Take me, for instance. A few months ago, I was just itching to get rid of my buggy old Research In Motion Ltd (NASDAQ:BBRY) Bold smartphone after nearly two years of frustration with its subpar ecosystem, slow download speeds, network outages, and botched software update pushes. While I knew Research In Motion Ltd (NASDAQ:BBRY) had bigger and better plans going forward, the fact remained that I had little faith remaining in the company’s products or infrastructure.

Tough to beat “free”

Meanwhile, I had bitterly watched nearly everyone else I knew zip around with a comparatively quick iPhone, with their enviable access to nearly every neat little app imaginable. As a result, when I had the chance to start a new two-year contract with Verizon Communications Inc. (NYSE:VZ) in February, I promptly ordered my new iPhone 4.

For free.

Oh, and did I mention it was free?

You see, I’m one of the apparently large camp of folks who really doesn’t care whether they have the latest and greatest tech available at any given time. Heck, I still drive around my wife’s first car — a ’98 Cavalier with more than 200,000 miles on it. Does my 6-foot-4 frame look awkward getting out of that car? Sure. Do I care? Not really.

Similarly, I’m more than happy with my “old” iPhone, especially considering I’ve never known any other. And when the time comes to renew my contract in a couple of years, I’ll gladly upgrade to whichever version of the iPhone 5 happens to be free at that time.

So how, exactly, is this good for Apple?

While Apple certainly gets less per device from Verizon Communications Inc. (NYSE:VZ) on older products, that still doesn’t mean it won’t eventually get our money.

In fact, I’ve spent more than my fair share in Apple’s iTunes and App Store buying apps, music, television episodes, and movie rentals through both my iPad and iPhone. And that, my fellow Fools, is where forward-looking companies such as Apple and Amazon.com, Inc. (NASDAQ:AMZN) know the real money is to be made down the road. The difference between Apple and Amazon.com, Inc. (NASDAQ:AMZN), however, is that Apple is already making boatloads of cash as it grows its already massive digital infrastructure.

The article Why Is Verizon Still Selling So Many Old iPhones? originally appeared on Fool.com and is written by Steve Symington.

Fool contributor Steve Symington owns shares of Apple. The Motley Fool recommends and owns shares of Amazon.com and Apple.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.