Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does AT&T Inc. (NYSE:T) fit the bill? Let’s take a look at what its recent results tell us about its potential for future gains.

What we’re looking for

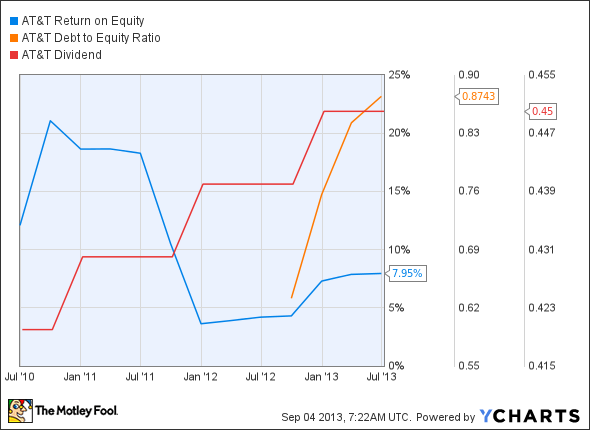

The graphs you’re about to see tell AT&T Inc. (NYSE:T)’s story, and we’ll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at AT&T Inc. (NYSE:T)’s key statistics:

T Total Return Price data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 3.8% | Fail |

| Improving profit margin | (42.7%) | Fail |

| Free cash flow growth > Net income growth | 15% vs. (40.5%) | Pass |

| Improving EPS | (35.5%) | Fail |

| Stock growth (+ 15%) < EPS growth | 64.8% vs. (35.5%) | Fail |

Source: YCharts. *Period begins at end of Q2 2010.

T Return on Equity data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | (34.2%) | Fail |

| Declining debt to equity | 58.5% | Fail |

| Dividend growth > 25% | 7.2% | Fail |

| Free cash flow payout ratio < 50% | 52.1% | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we’re going

Things don’t look very favorable for AT&T Inc. (NYSE:T) today — the telecom giant musters a miserable one out of nine passing grades. Its revenue growth fails to keep pace with three years of inflation, and a weakened net margin has been its main sources of weakness. However, AT&T shareholders have enjoyed solid growth over the past three years as investors flock to perceived safe havens. Is AT&T’s share-price improvement sustainable, or will its recent fundamental weaknesses produce underperformance going forward? Let’s dig a little deeper to figure out what the future may hold.

AT&T Inc. (NYSE:T) never really had a chance of gaining a stake in that company, but with any buyout of T MOBILE US INC (NYSE:TMUS) long since rejected by federal regulators, and with Sprint Nextel Corporation (NYSE:S) becoming a Softbank property, the U.S. wireless industry has been effectively decided for the foreseeable future. All that remains now is a price war, and that will not help AT&T’s flagging margins at all.

There does remain one rather bite-sized acquisition on the horizon, though. My Foolish colleague Evan Niu notes that AT&T Inc. (NYSE:T) has been mulling a bid for more spectrum, which would enable it to provide enhanced wireless services to more consumers. The company is planning to take over Leap Wireless International, Inc. (NASDAQ:LEAP)‘ prepaid Cricket service for an estimated $1.2 billion, which not only adds coverage, but also brings on one of the few prepaid “success” stories in an American market dominated by two-year contracts. AT&T has also been deploying large and small cell cites as part of its Project Velocity IP program to strengthen its LTE coverage.

AT&T Inc. (NYSE:T) has also rolled out a new mobile upgrade plan called “AT&T Next,” which will allow customers to upgrade their devices every year without any down payments, fees, or service contracts. However, they will be charged a fixed monthly installment in the range of $15 to $50 depending on the handset. Fool contributor Doug Ehrman notes that T MOBILE US INC (NYSE:TMUS)’s JUMP! Plan and Verizon Communications Inc. (NYSE:VZ)’s Edge are two options already allowing customers to upgrade twice per year, but the latter requires customers to pay half of the device cost before upgrading.

Putting the pieces together

Today, AT&T Inc. (NYSE:T) has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy — or to stay away from a stock that’s going nowhere.

The article Is AT&T Destined for Greatness? originally appeared on Fool.com and is written by Alex Planes.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Vodafone.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.