Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does AT&T Inc. (NYSE:T) fit the bill? Let’s take a look at what its recent results tell us about its potential for future gains.

What we’re looking for

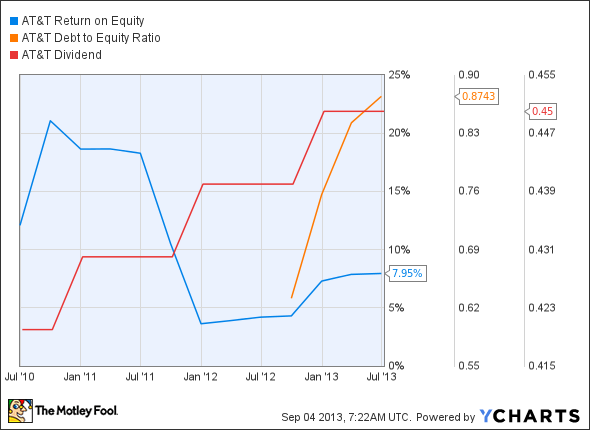

The graphs you’re about to see tell AT&T Inc. (NYSE:T)’s story, and we’ll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at AT&T Inc. (NYSE:T)’s key statistics:

T Total Return Price data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 3.8% | Fail |

| Improving profit margin | (42.7%) | Fail |

| Free cash flow growth > Net income growth | 15% vs. (40.5%) | Pass |

| Improving EPS | (35.5%) | Fail |

| Stock growth (+ 15%) < EPS growth | 64.8% vs. (35.5%) | Fail |

Source: YCharts. *Period begins at end of Q2 2010.

T Return on Equity data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | (34.2%) | Fail |

| Declining debt to equity | 58.5% | Fail |

| Dividend growth > 25% | 7.2% | Fail |

| Free cash flow payout ratio < 50% | 52.1% | Fail |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we’re going

Things don’t look very favorable for AT&T Inc. (NYSE:T) today — the telecom giant musters a miserable one out of nine passing grades. Its revenue growth fails to keep pace with three years of inflation, and a weakened net margin has been its main sources of weakness. However, AT&T shareholders have enjoyed solid growth over the past three years as investors flock to perceived safe havens. Is AT&T’s share-price improvement sustainable, or will its recent fundamental weaknesses produce underperformance going forward? Let’s dig a little deeper to figure out what the future may hold.

AT&T Inc. (NYSE:T) never really had a chance of gaining a stake in that company, but with any buyout of T MOBILE US INC (NYSE:TMUS) long since rejected by federal regulators, and with Sprint Nextel Corporation (NYSE:S) becoming a Softbank property, the U.S. wireless industry has been effectively decided for the foreseeable future. All that remains now is a price war, and that will not help AT&T’s flagging margins at all.