With talk of slowing the Federal Reserve’s bond-buying program, treasury yields have started to rise. The yield on the 10-year treasury is now at a 52-week high after rising sharply in May, making fixed-income investments more attractive. Because rates have been so low since the financial crisis, investors have piled into high-yield dividend stocks in search of income. This has driven the price up and thus the yields down. On May 29 we saw many of these stocks dive in price as investors sold their positions as treasury rates hit their high.

Are all dividend stocks in danger from rising interest rates? Or are some safer than others?

Some stocks are like bonds

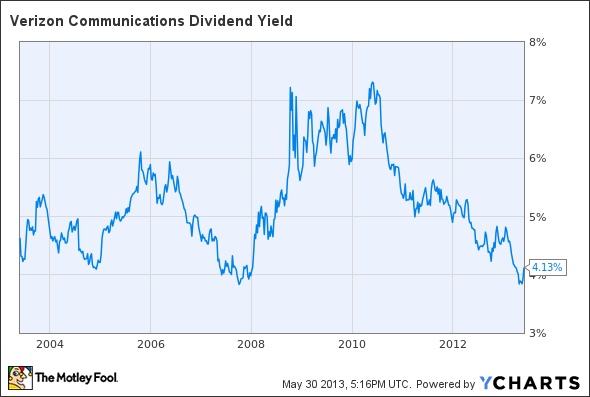

Many of the stocks hit hardest on May 29 were traditional dividend stocks held in countless retirement portfolios. These typically are large, high-quality companies with above-average dividend yields. Verizon Communications Inc. (NYSE:VZ), the telecom giant, fell by 2.5% on May 29 and has fallen about 9% from its high earlier in May. Verizon Communications Inc. (NYSE:VZ) is the kind of stock that people buy solely for the yield, and in the past a yield topping 6% was attainable.

VZ Dividend Yield data by YCharts

If you notice in the graph above, right before the financial crisis hit, Verizon Communications Inc. (NYSE:VZ)’s yield was at just about 4%. Then, as all stocks fell in price, the yield shot up above 7%. But since the beginning of 2010 the yield has been constantly falling and has now reached a level similar to right before the financial crisis.

Investors have been buying stocks like Verizon Communications Inc. (NYSE:VZ) hand over fist because fixed-income investments have offered such low rates over the past few years. But all of this buying has pushed the yield down too far, making the stock unattractive. A 4% dividend yield may seem great, but in this case it’s not.

Why? Because dividend stocks have two components: yield and growth. Unlike bonds, which have fixed payments until they mature, dividend stocks have the capability to increase payments over time. But stocks like Verizon Communications Inc. (NYSE:VZ) will likely only grow the dividend at 2%-3% per year, so the yield needs to be extremely high for owning the stock to make any sense. Because of this, the stock will behave similarly to a bond in a rising interest rate environment – the price will fall.

I wouldn’t touch Verizon Communications Inc. (NYSE:VZ) stock unless it carried a yield of around 6%. If you own Verizon now, I would get rid of it. There are much better dividend options out there.

Tech dividends

Dividend stocks with low dividend growth rates will likely fare the worst in the coming years, but one sector that has created a deluge of dividend stocks since the financial crisis is the tech sector. With high yields, high dividend growth rates, and low payout ratios, big tech companies may be the best dividend stocks available today.

My Ultimate Dividend Growth Portfolio, which you can track here, includes a handful of attractive tech dividend stocks. These stocks will likely be far less affected by rising interest rates compared to stocks like Verizon.

Cisco is a good example. The company has raised its dividend twice in the last year after initiating it in 2011, and after the most recent increase the projected dividend yield is a solid 2.75%. Cisco stock has risen substantially since the beginning of May, and in The Ultimate Dividend Growth Portfolio the yield on cost for the Cisco position is 3.15%.

What makes Cisco even more attractive as a dividend stock is that the projected dividend only eats up about 35% of the company’s annual free cash flow. And with a stock buyback program pushing this payout ratio down by reducing the share count, the dividend has plenty of room to grow even with slow earnings growth.

Another nice thing about Cisco is that the company is sitting on a mountain of cash. With about $32 billion in net cash, this could cover the current annual dividend payment for almost 10 years. Some of this cash is held overseas, limiting its use for dividend payments, but it still provides added support.

I expect that we’ll see significant dividend growth from Cisco in the coming years as the company returns more cash to shareholders. Although Cisco was cheaper a couple of months ago, it’s still attractively priced today.

Another big tech company with an attractive dividend is chip giant Intel Corporation (NASDAQ:INTC). Intel Corporation (NASDAQ:INTC) has a 3.7% yield, not too far below that of Verizon, and is likely to grow the dividend far faster than a few percent per year. While the dividend eats up 57% of 2012’s free cash flow, the payout ratio is only 40% with respect to net income.

In the short term the company’s dividend growth may be slow, as Intel Corporation (NASDAQ:INTC) is spending tremendous amounts of money on capital expenditures as it pushes its manufacturing processes forward. In order to compete in the mobile space, Intel Corporation (NASDAQ:INTC) needs to make its processors more energy efficient, and within a couple of years the company should have a product that is superior to the ARM-based processors, which currently dominate mobile devices.

Long-term, Intel Corporation (NASDAQ:INTC) is setting itself up to remain the dominant player in the microprocessor industry, and strong dividend growth should follow from this. With a yield close to 4% today, it’s hard to go wrong.

The bottom line

With interest rate set to inevitably rise, many dividend stocks that have been bid up over the past few years will likely be hit hard. Stocks like Verizon and many consumer staple stocks look unattractive at their current yields, and an alternative for those looking for income is big tech. With the capacity for fast dividend growth and above-average yields, these tech stocks will likely be unaffected by rising interest rates largely because the stocks aren’t viewed as traditional, safe dividend stocks. But with yields pushed down on so many popular dividend stocks, their safety comes into question.

The article Will Rising Interest Rates Affect Dividend Stocks? originally appeared on Fool.com.

Timothy Green owns shares of Cisco. The Motley Fool recommends Cisco Systems (NASDAQ:CSCO) and Intel. The Motley Fool owns shares of Intel. Timothy is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.